MyCreditCounselor

Andrew Weber

Turning Large-Balance Private

Student Loans into $0.

Since 2013.

Click to Receive a Free Private Student Loan Evaluation

Why People Choose Andrew Weber, Credit Counselor,

for Private Student Loan Settlement

Destroy your balance and prevent lawsuits

We will remove your private student loan once and for all – before legal action occurs.

Drastically improve your finances

Feel what it’s like to be DEBT-FREE

Certified Counselor, with 60+ 5-star reviews

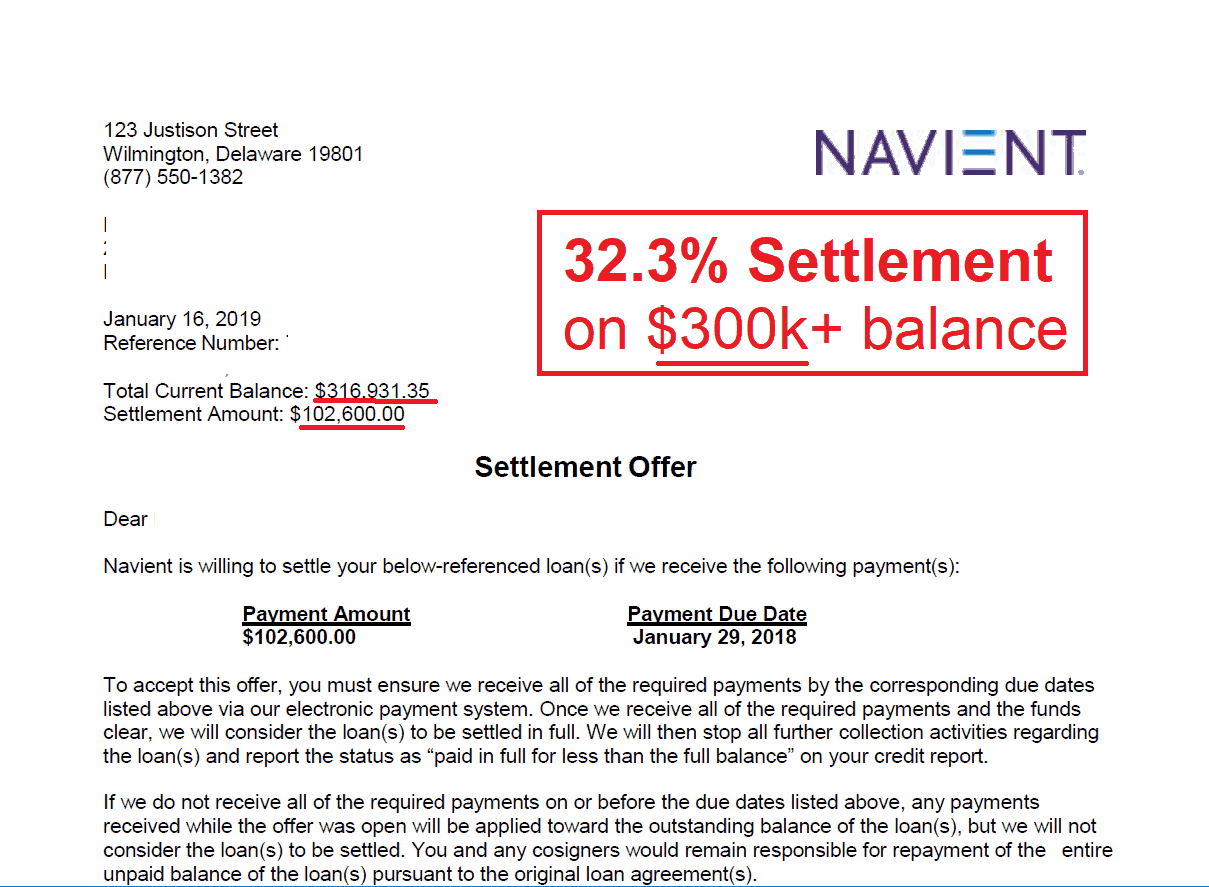

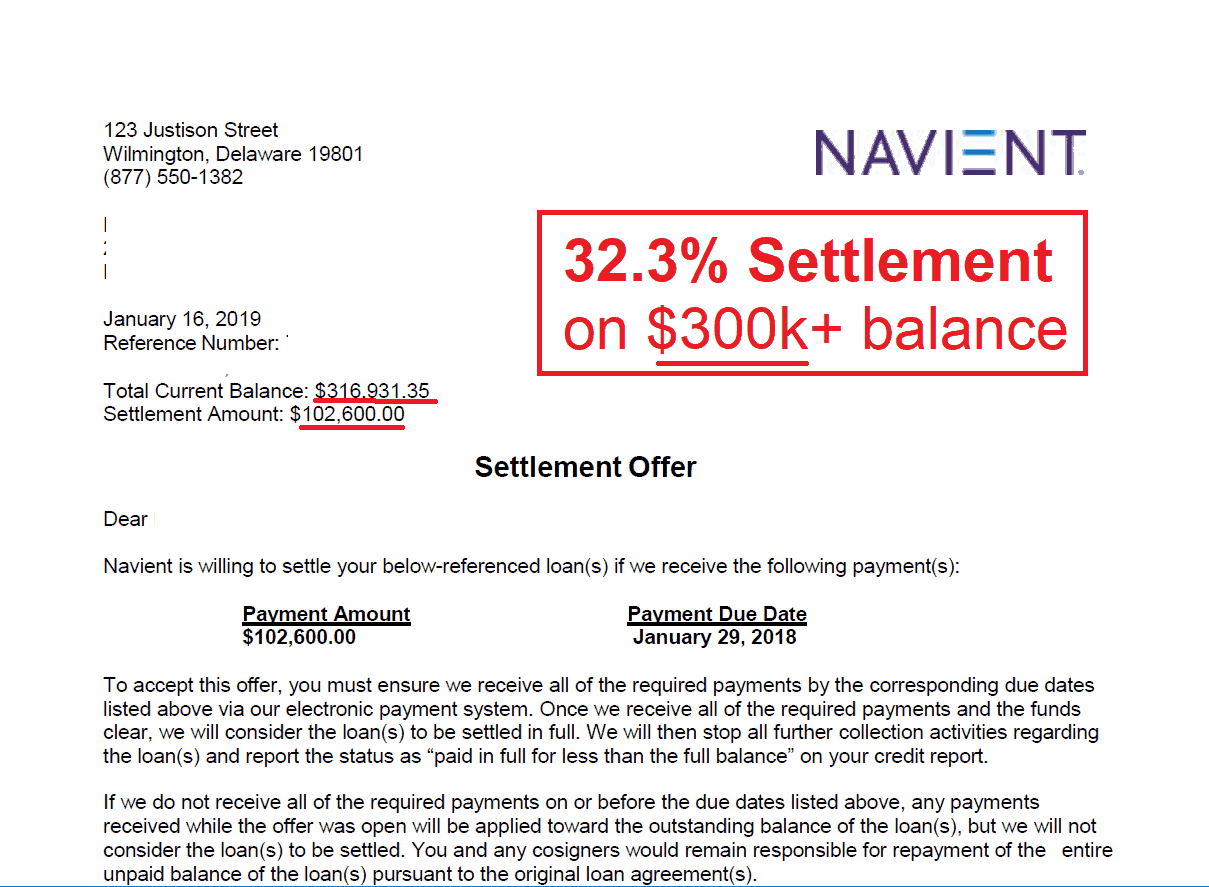

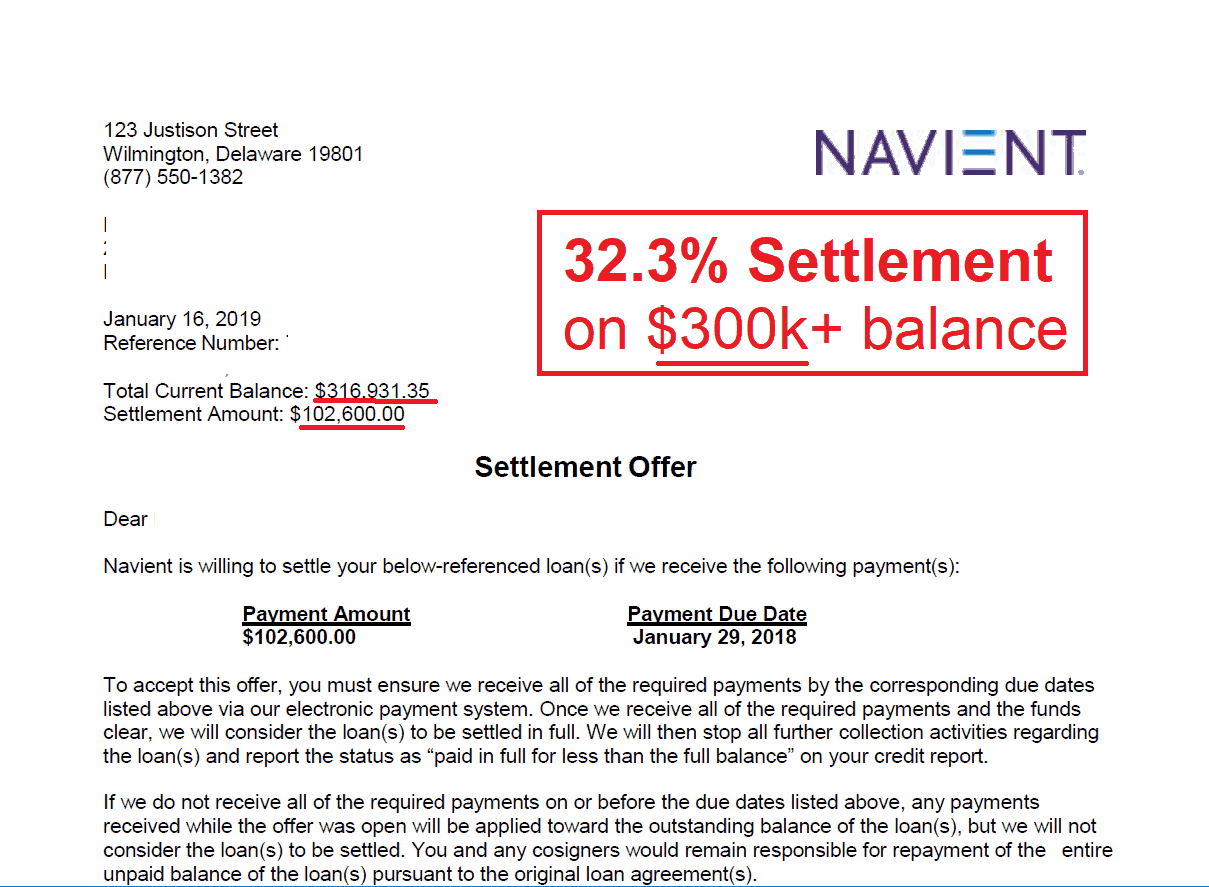

Private Student Loan Settlements Examples

Success Stories

As Featured In

Meet Andrew Weber

Your Credit Counselor

Are you struggling with a large private student loan that never seems to go down, no matter how long you’ve been paying on it?

Are your interest rates and payments skyrocketing?

Maybe you have accounts in default..

and are being hounded by debt collection agencies, or even law firms?

Or maybe you’re a cosigner, and have taken on a burden you never imagined when you signed on those loans many years ago.

Whatever your situation – I’m here to help!

Your Gateway to a New Life

Settling a debt is an investment in your future self and your future bank account.

Imagine a life where you aren’t being held back by a high debt to income ratio (DTI) – allowing you to qualify for the house of your dreams.

Imagine a life where you aren’t chained as a cosigner to someone else’s loan, that you never thought you would end up being responsible for.

Imagine a life where you’re not worried about a debt collection lawsuit or getting harassed by debt collection calls.

Where you are instead focused on building personal and business credit, making investments, spending time with your family, or traveling the world.

All of these things are possible!

I'll Do the Heavy Lifting

I help close the gap between where you are now, and the life that you want to have.

It will take some effort and sacrifice – there is no silver bullet (beware of debt validation scams that promise to get rid of your debt with a couple of letters).

I’m here to take on as much of the burden as possible, handling all communication and negotiations, and saving you the maximum amount – while making sure settlements are done properly.

I Have a Unique Set of Skills

I specialize in settling high-balance, high-risk student loans over $20,000 – but many of our clients have balances over $100,000. My largest settlement was on a balance of $317,000.

With larger balances, more can go wrong if the settlement is not executed correctly, and there is a greater risk of legal action.

With effective negotiations based on years of settlement knowledge, high-level strategy, and established industry relationships – I will make sure you save every single dollar possible (and my performance-based model also incentivizes me to do this as well).

Accounts that I settle, stay settled. You won’t have to worry about them coming back to haunt you.

Along with my comprehensive 17-page Credit Building Guide and a world-class credit repair agency that we refer to, you will be back into a good credit score range within 6 months – 2 years after settlement in most cases.

Click to Receive a Free Private Student Loan Evaluation

16 Years Of Full Spectrum Debt Negotiation Experience

I’m the TOP non-attorney private student loan settlement specialist in the United States, having helped hundreds of borrowers settle all types of debts (especially private student loans) for much less than the balance owed.

I began settling credit card debt as the lead negotiator for a large debt settlement company in 2009, became a certified credit counselor and struck out on my own in 2011; and settled my first private student loan in 2013.

I have settled multiple millions of private student loan debt with all of the major lenders, and many minor ones as well.

Private Student Loan Lenders and Collection Agencies I Work With

- Navient

- Sallie Mae

- National Collegiate Trust (NCT)

- Turnstile Capital Management

- Discover

- Keybank

- Wells Fargo

- Citizens Bank

- Citibank

- Firstmark

- Nelnet Trust

And many more.. not to mention dozens and dozens of different collection agencies, law firms, servicers, and debt buyers in addition to original lenders, banks and credit unions.

Debts That I Have Settled in My Career

- Credit cards

- Student loan refinances

- Bank loans

- Credit union loans

- Federal student loans (in rare cases only)

- Medical debts

- Signature loans

- FinTech/online lending platform loans

- Auto loans (after repossession)

- Legal bills

Personal Experience

A lot of people think that credit counselors and financial professionals never make their own mistakes or end up in bad situations themselves – this couldn’t be further from the truth.

Between starting my business in the shadow of the Great Recession, and navigating the first couple of years of the pandemic as a small business owner – I’ve dealt with my fair share of hardship and financial struggle.

At different points over the past 15 years, I have:

- Been in heavy credit card debt

- Represented myself in court against a credit card lawsuit and settled it with the opposing counsel

- Been in default on federal and private student loans

- Consolidated my own federal student loans out of default and applied for income driven payments

- Settled my own private student loans

- Owed over $100,000 in debt

- Gotten hit with thousands of dollars of medical bills that I thought my insurance would cover after surgery

- Settled many of those medical bills

- Experienced my credit score dropping into the 400s

- Experienced my credit score rising into the 700s

I know what it’s like to face the same battles you’re facing.

Personal finance is a journey at any time, but especially during the tumultuous and unpredictable global events of the 21st century.

My personal experience and struggles have helped to inform my business practices and allow me to connect on an emotional level with others who are going through some of the same things I have.

Things CAN get better with consistent effort and the right strategies! For proof, look no further than our 37+ 5-star reviews.

Click to Receive a Free Private Student Loan Evaluation

Settlement After Default

How Do Default And Settlement Affect Credit?

There’s a common misconception that settlement permanently ruins your credit.

This couldn’t be further from the truth.

This belief exists partly because of the inefficient “old school” debt settlement models that let people sit in default for multiple years before ever attempting to settle. If you’re already in default or seriously delinquent, the damage is already done for the most part.

The credit damage comes from the late payments and default notations – not the settlement itself.

We recommend all our clients go through reputable credit repair firms to repair and rebuild their credit after settlement. We do provide referrals.

Successful credit restoration can jumpstart this even faster – the firm we refer to has been able to get late history and defaults deleted for my clients post-settlement.

They’ve even achieved deletions for me personally in the past, so I can say firsthand that they are very effective.

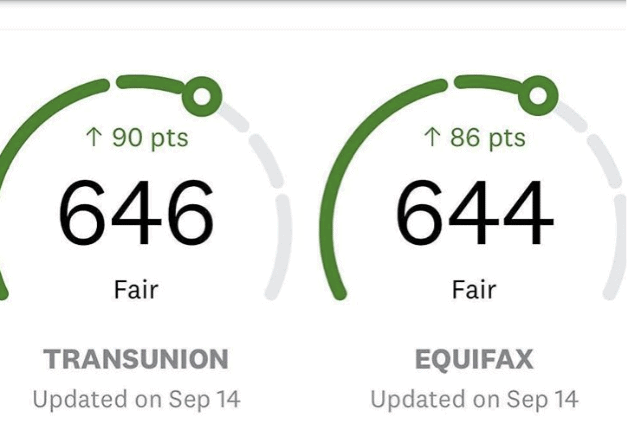

Results from an actual client after the $0 balance from their settlement was updated with the credit bureaus. No other credit building or credit repair actions have been taken yet.

The Facts

The sooner you settle after default, the sooner your credit will recover. My philosophy is based on maximizing savings, while minimizing risk and the amount of time credit is damaged.

The settlement itself will actually be the first positive action in rebuilding your credit – I’ve seen scores jump by up to 90 points (this is what led to the screenshot above) after the $0 balance and settlement notation is reported to credit bureaus, once negotiations are finished.

For accounts that have been in default for longer than a couple years, the positive impact will not be as major, but this will still clear the way for credit rebuilding, mortgage approval, and the like.

It is a trade off of short term but significant credit damage – in exchange for significant monetary savings. The higher the balance, the more this trade-off is worth the trouble of the strategic default.

Although past negative marks will remain for a period of seven years, they do not have as heavy of an impact on your score for that long. Negatives have less of an impact after 2 years. Oftentimes, negative remarks can be removed through effective credit repair.

By settling out a defaulted private loan or other debt and following my credit-building advice, most clients are back into a good score range within 1-2 years after settlement.

Ready to start your journey toward being debt-free?

Click to Receive a Free Private Student Loan Evaluation

Featured Articles