Can Private Student Loan Debt Be Settled And If So, How Do You Negotiate A Successful Settlement?

As a NACCC Certified Student Loan Counselor, NACCC Certified Credit Counselor, and a professional debt negotiator with over 15 years of experience; I am well equipped to negotiate your private student loan settlements – and to make sure that the negotiated agreement is executed correctly.

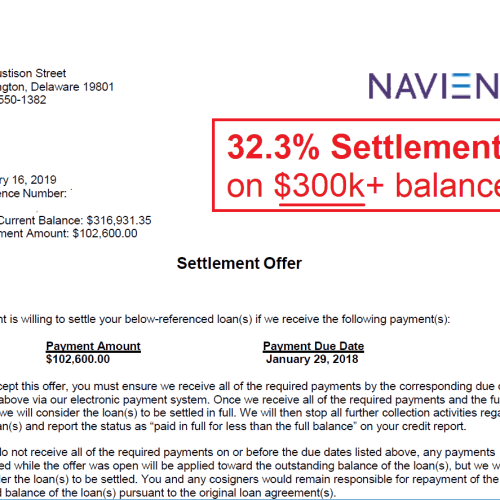

I specialize in settling high balance, high risk private student loan accounts , which require a more nuanced approach and strategy compared to normal balances. With a larger balance, there is more to lose if something goes wrong, and more to gain with expert, relationship-based negotiation.

Our minimum client balance is $40k. If you have a lower balance than this, not to worry – we can refer you to another skilled negotiator.

But you may be surprised to learn that the average private student loan balance in the United States is actually $50k.

I will make sure that your private student loan settlements is executed correctly, with proper credit reporting from the lender.

The execution and follow-up of the negotiated agreement is where people can get into real trouble when trying to settle on their own, or by hiring settlement companies that don’t specialize in private student loan settlements negotiation.

I never charge upfront fees – my charge is due at the time the negotiated agreement is executed.

My performance-based method gives me the incentive to save every last possible dollar for my clients.

Beware of debt negotiation companies that charge you a percentage of the total debt amount instead of the savings – not only does this mathematically come out to a much larger fee than mine as far as the dollar amount; it also means that they do not have an incentive to save you as much as possible and to go that extra mile to maximize the amount you can save.

Under their “percentage of the full balance” model, the fee is the same whether the reduced sum payoff is 40%, 50%, or 60% – they are still getting paid the same amount regardless of how low your negotiated agreement is.

For this reason, I view the “percentage of the total balance” fee model as inferior to my performance based “percentage of the savings” model.

If you read our 39+ 5 star reviews, you’ll see that our past clients also agree!

Strategy and Tactics

My strategies and tactics have been honed over time – specific to certain lenders, as well as various situations at different points in the collection cycle.

For example, the approach to settle with a collection law firm is different than the approach with an internal collection department, even if the lender is the same.

Experience and Industry Knowledge

I’ve spent over a decade of my career negotiating with all different types of debt collectors, collection attorneys, collection supervisors, managers, directors, banking executives, Private student loan settlements and many others.

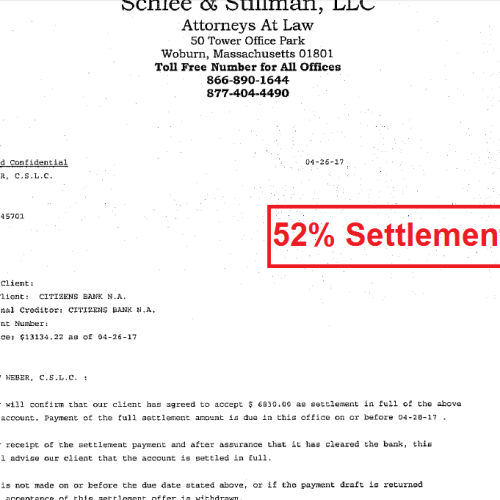

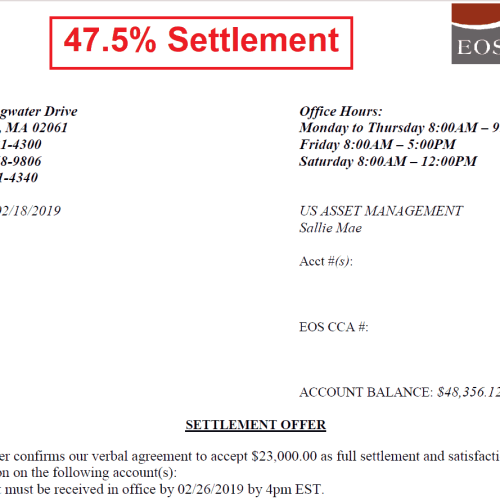

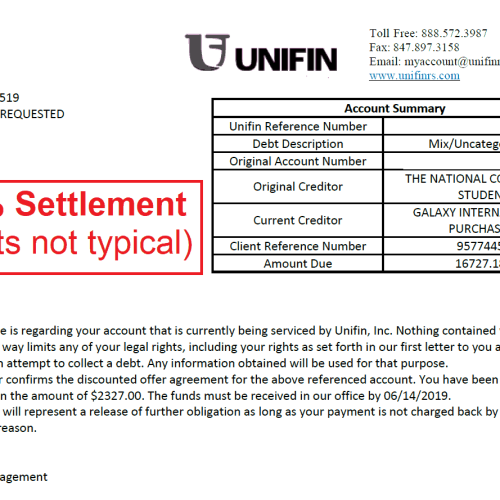

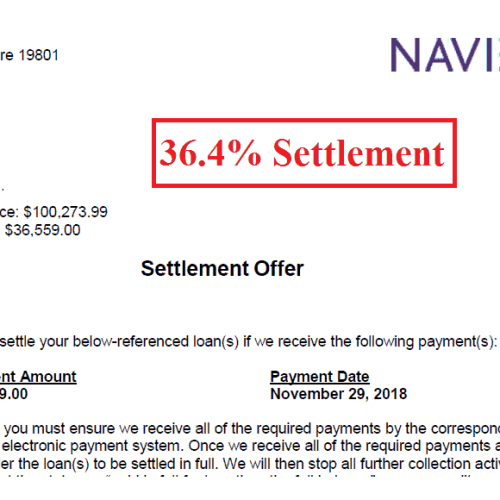

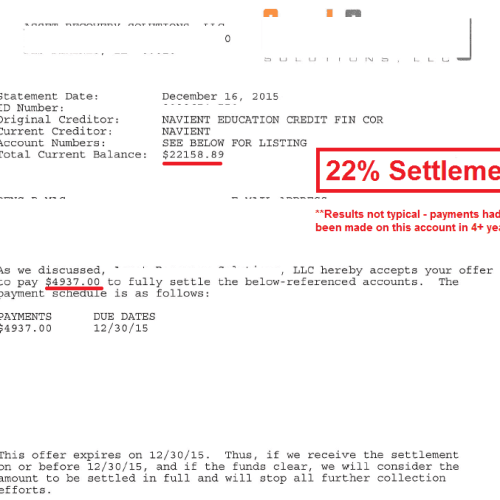

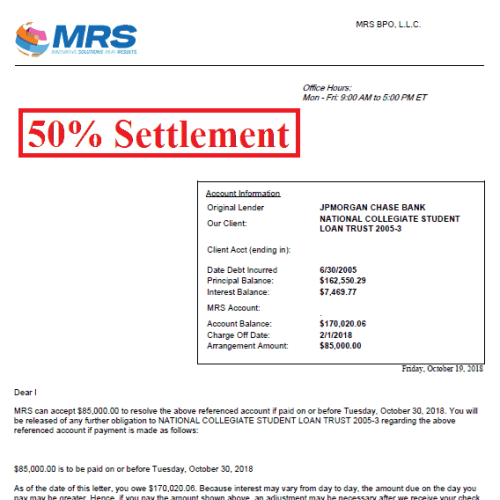

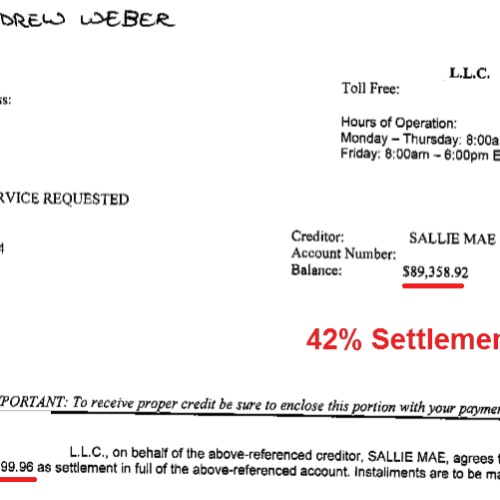

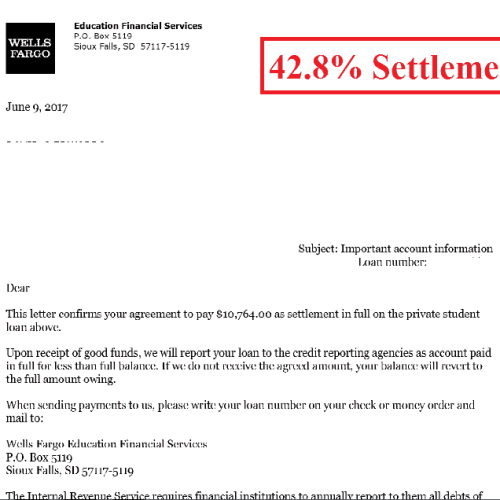

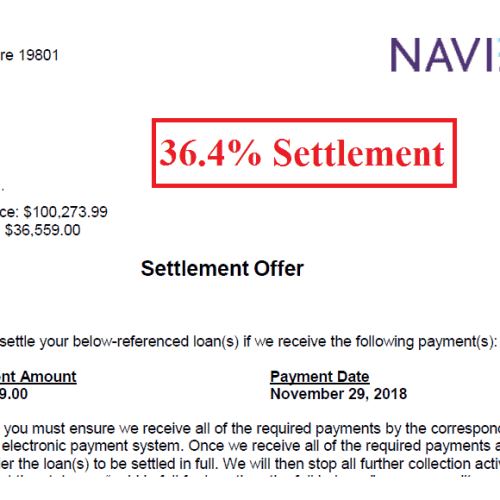

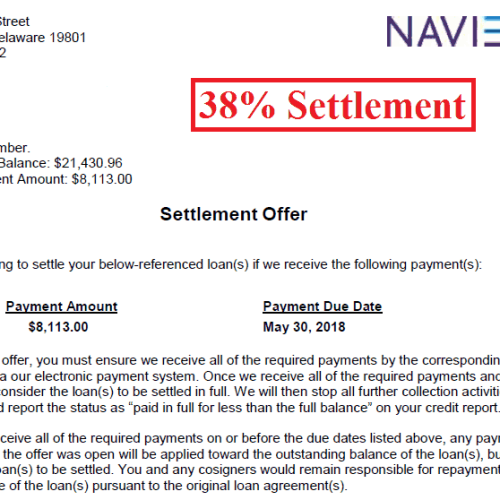

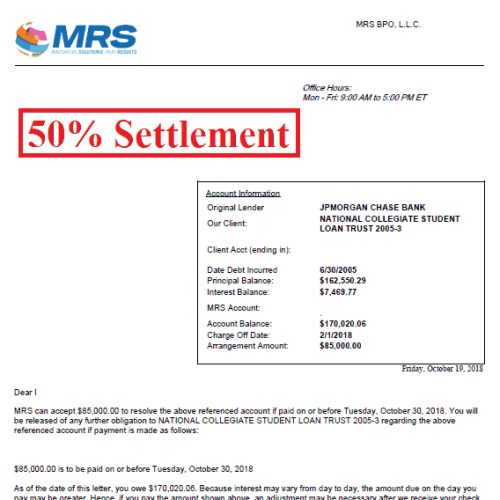

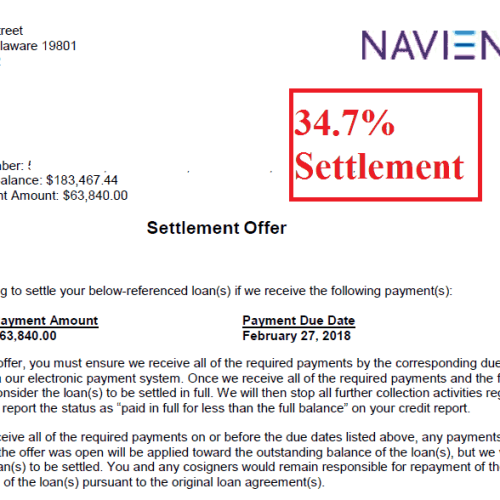

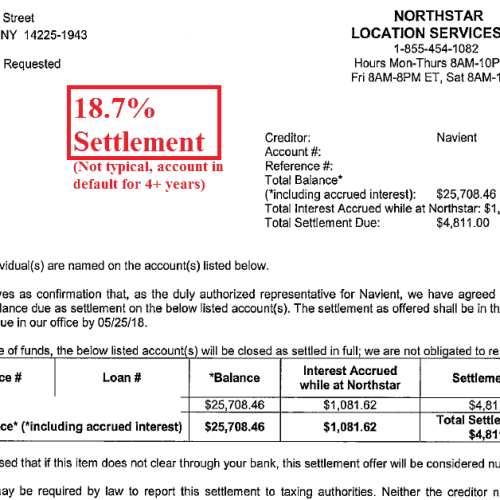

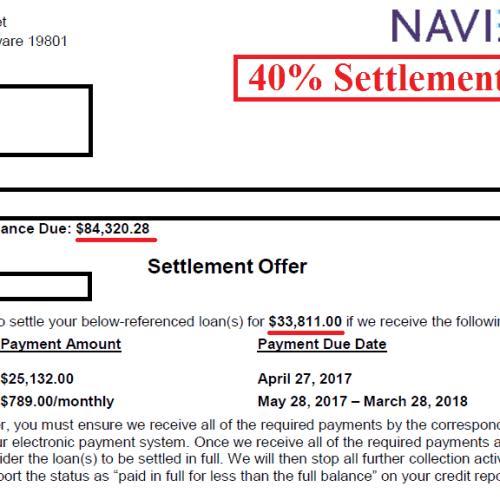

I have been able to negotiate private student loan settlements with the largest private lenders such as Navient, NCT, Wells Fargo, Keybank, and Sallie Mae; as well as with a variety of smaller or more obscure lenders. I have negotiated for years with many debt collectors, law firms, and debt buyers such as Williams and Fudge, Weltman Weinberg and Reis, Asset Recovery Solutions, MRS, Allied Interstate, National Enterprise Systems, Transworld Systems, and many many more.

Thousands of difficult negotiation situations has given me an extensive negotiating “toolbox”, and a deep well of knowledge to rely on as far as lender behavior and reading between the lines during a negotiation.

Private student loan settlements can vary significantly in terms of collection cycles, legal tactics, and potential reduced sum payoff ranges employed by different lenders.

Negotiating Relationships

The student loan industry is not quite as vast as the credit card industry in terms of the agencies and lenders involved, so over time,For some of the Private Student Loan settlements that I handle, I end up negotiating with many of the same companies and collection agencies repeatedly.

I’ve known some of the managers, directors, and supervisors at various lenders and collection agencies for years.

I never forget that I work for only my clients and they work only for the lender, but there is mutual overlapping interest when it comes to negotiating an agreement.

These negotiating relationships play a big role in the results that I’m able to achieve.

Do I Need an Attorney for My Private Student Loan Settlements? Will I Get Sued?

When loan holders contact me with active lawsuits or a recent summons, I refer them to some of the top student loan attorneys in the country, many of whom I’m on a first name basis with.

However – you do not need to hire an attorney (and pay their upfront retainer fee) to handle your private student loan settlements unless you are faced with a legal situation such as being served with a summons, or a wage garnishment.

Negotiate Private Student Loan Settlement Payoff: How Do I Get Results?

I have never had a client get sued, and that is not by accident – my unique method minimizes risk while maximizing savings.

It’s easy to see a lawsuit coming from a mile away if you know what to look for, and in situations where it looks possible, we simply play defense (often in the form of a temporary repayment plan) to prevent legal action while continuing forward with student loan negotiation, aiming for a reduced sum payoff.

In some cases, I’ve even been able to leverage my negotiating relationships with lenders to have them pull an account from a collection law firm, and place it back with a non-legal collection department for the lender.

Keep in mind that student loan defense attorneys who help with debt settlements would be limiting themselves to a very small portion of the market if they only accepted potential clients who have active lawsuits, so they will make up reasons or sometimes use scare tactics about why you need legal representation for a settlement negotiation such as private student loan settlements that takes place outside of litigation.

It’s a business decision for them – one that results in signing on more clients than if they only signed on people who are facing active litigation – but is not based on any actual legal need for you to hire them for representation.

A student loan lawyer is not doing anything different than a non-attorney negotiator during the negotiating process unless you have an actual legal situation.

But, they are probably going to take full advantage of their exemption to the “no-upfront fee rule” by charging you an upfront retainer fee.

Don’t get me wrong – I love the student loan defense attorneys that I know and refer legal situations to them often.

You just don’t need to hire one unless you’ve been sued.

If you actually do have a summons to court or other issue that requires an attorney, I’ll help you find one, or refer you to one of the many accomplished student loan attorneys I’ve met in the industry.

I don’t take on legal situations or provide legal advice. If you’ve been served a summons, I can’t help you – there is a separate legal process that has to take place at that point along with any negotiation, and you need a skilled student loan attorney for that.

At any point prior to actually being summoned to court, I can usually negotiate an agreement.

Fortunately, legal action is usually a last resort for a lender and there are often many opportunities to settle prior to that happening.

Assignment to a collection law firm or collection agency is somewhat common, and by itself the assignment does not mean you have a legal situation.

I settle with these firms regularly.

The assignment to a collection law firm does usually mean that a lawsuit is imminent within several months or less if no agreement or repayment plan is worked out.

Therefore, it’s important to take immediate action if you get a letter or phone call from a collection law firm regarding a defaulted loan.

My Method vs. the Ineffective “Old School” Debt Relief Model

I make sure that you, as the loan holder or cosigner, are fully informed before signing on with me.

I make sure that you, as the loan holder or cosigner, are fully informed before signing on with me.

If pursuing loan settlement offers isn’t in your best interest, I won’t sign you up, and will instead recommend an alternative strategy. The same applies if you’re not in a position to afford a lump sum payment.

The main problem with the “old school”, sales-focused debt relief model that many companies use (and have used for decades) is that it results in signing on people who are NOT a good fit for student debt settlement.

The “old school” debt relief model involves saving up over years via monthly deposits with the hopes of eventually settling (usually sent directly to the debt settlement company, who takes part of each student loan payment for their fee) – and it does not work on large accounts, where the student loan lender can be legally aggressive within 6-12 months after default or less.

Larger private loan balances are impossible to settle with ongoing saving deposits from income and usually require some type of access to funds, assets, or any other money in the bank that has already been built up by the time of default.

You can use ongoing/future income to help fund a reduced sum payoff over time, but you’ll still need some funds on hand for the down payment at the time the agreement is executed.

I screen carefully and only accept those who are truly a good fit for my process. Being a good candidate requires, among other things, having the funding to lock in a lump sum or structured settlement shortly after default – minimizing the risk of legal action, while maximizing what you’re able to save.

Settling shortly after default, preferably with a lump sum, also results in credit scores going back up much faster than the inefficient, “old school” debt relief model.

That model, which drags on for years with accounts remaining in default and at risk of litigation, is also why debt settlement is associated with credit being permanently ruined. However, this is not the case when a negotiated agreement is done correctly.

Can You Strategically Default On Your Private Student Loan Settlements?

Of course, the credit drop I refer to above only applies to those who are current on their loans and are looking to strategically default.

For those who are already in default by the time they contact me, negotiating a reduced sum payoff will only increase their score after the account has defaulted – the credit damage has already been done at that point.

For those who are current, they must weigh whether the temporary (but significant) damage to their credit history is worth the monetary savings obtained via settlement.

If there’s a cosigner involved (which is the case for the majority of private student loans settlement concern are private) they need to be on board with this strategy as well, and understand how their credit will be affected, and when it will recover.

No counselor, debt relief company, or negotiator should ever instruct you to stop paying on your loans in order to settle. It’s a serious decision that only you should make, after being fully informed of the pros and cons and determining whether it is worth it for your financial situation and future goals.

People often ask me what I would do in their shoes, but I won’t answer that question – it’s just not my decision to make. My role is to provide you the objective information that you need to make a fully informed decision on whether to strategically default and settle.

If you decide to, I can walk you through every step of the way and ensure that there’s a successful settlement at the end. Many of my clients have chosen to pursue this route.

Get started by clicking the button below and request your online evaluation today!

REQUEST YOUR FREE EVALUATION TODAY

Can You Consider Refinancing Your Debt from Private Student Loan Settlements?

Since most lenders will only begin to negotiate when the accounts are defaulted, those who have current private loan debt with a good credit profile may benefit from looking into refinance.

Be aware that a high Debt to Income ratio can prevent you from being approved for a refinance even if you have a good credit score – it’s actually the number one reason for declined applicants.

Refinance is the other main relief option for private loans besides settlement. You will still pay much more over time with a refinance than a settlement, but you won’t experience the temporary credit drop from a strategic default in order to settle.

If you are interested in refinancing your federal loans, please visit my federal student loan page for more information.

Refinance can be difficult to get approved for.

That industry has come a long way since it was known as an option just for “doctors and lawyers”, but you’ll still need to have good income, a good Debt to Income ratio, no accounts in default or delinquent, and possibly a cosigner.

For those who don’t qualify, or those that want to slash their balance by 50% or more instead of just lowering their interest rate, settlement is an option.

When It Comes To The Debt Industry: Caveat Emptor

The debt settlement industry has a bad reputation for a reason.

We’re prohibited from charging upfront fees, or any type of initial retainer (unlike almost all other service-based industries) for a reason.

The bad actors tend to make things harder for the good guys, although the tides seem to be shifting in that regard.

Companies that try to take out fees prior to settling your accounts are hedging their bets – they think they may not be good enough to negotiate a settlement for you, so they try to take out fees before any agreement has been reached.

There is a loophole in the no-upfront fee laws that allows companies to charge you upfront if there is an “in person sales presentation”, so beware of companies who want to send a notary or sales agent to meet you in person.

Despite the fact that upfront fees were outlawed in the TSR Amendments of 2010, many companies still try to collect fees before settlement in some way. Read the fine print of debt settlement company contracts carefully.

Law firms in a state outside of yours that contact you via inter-state telemarketing (inbound or outbound) are also subject to the “no upfront fee rule”.

“Debt Validation” companies have started popping up that claim that they, without actually representing you legally, can get your loans dismissed, canceled, forgiven, removed, etc. via different disputes under the Fair Credit Reporting Act, the Fair Debt Collection Practices Act, and others.

They actually can’t. I’ve written extensively on this topic here about why these are false claims (although their salespeople sure make it sound good to folks who don’t know any better).

Unfortunately, by the time people realize that all the fancy and legalistic sounding disputes haven’t actually gotten their lenders to cancel their loans, they are years into default and have paid the company thousands in upfront and monthly fees.

These kinds of firms basically just try to wait out statutes of limitation while filing a bunch of frivolous complaints and disputes, and often try to use settlement as a backup (but they’ll never tell you that).

One client of mine who had hired one of these companies before finding me, had sent me a lot of the actual disputes and paperwork that the company had filed for them. This “debt validation” company had sent a lot of FDCPA Validation requests to Navient. The problem?

Navient is an original lender, and in the vast majority of states, they are not required to comply with FDCPA requests which are mainly applicable to just third party debt collectors.

The letters looked and sounded great to someone unfamiliar with the FDCPA – it’s just that Navient legally did not have to comply with them since they are an original lender.

If a company feels spammy, too sales focused, makes unrealistic promises, or is trying to rush you into signing a contract; pay attention to those warning signs.

Loan settlement is a serious decision, and you should take your time in deciding if it is the right path for you.

And no one can file a couple of disputes and get your private loan cancelled… if that was possible, trust me, I’d be doing that instead of taking all this time and effort to negotiate settlements!

Getting Started:

Have you decided that you’d like to become one of my settlement success stories, and zero your private student loans out for good?

No matter what obstacles you think stand in the way of settling your loans, there are often solutions that you may not be aware of.

I’m very creative when it comes to strategizing a path to victory for my clients.

To get started, click here to fill out my evaluation form so that I can take a closer look at your situation, or call me directly at 937-503-4680.