Out of all the questions I get from borrowers, “Is pursuing strategic default for Private Student Loan debt settlement a good strategy?” is one of the most common. A strategic default (like Private Student Loan) is when a borrower intentionally stops making payments in order for the account to default. No counselor or company should ever tell someone to default. It should be a decision the borrower (like those who avails Private Student Loan) makes on their own after considering the pros and cons, and weighing the outcome against their current situation.

When Is Strategic Default for Private Student Loans Likely An Option?

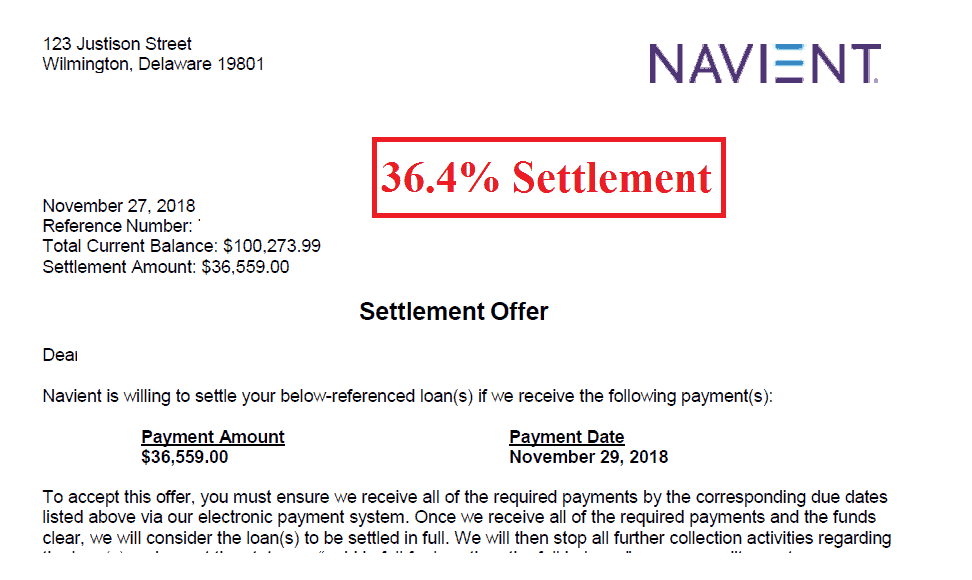

When Private Student Loan barely go down after paying huge monthly payments over several years, or in the worst cases when the balance does not go down at all or even increases; strategic default starts to enter the thinking of even those borrowers (like those who avails Private Student Loan) who have never missed a payment on anything in their lives. Ideally, only borrowers who will inevitably be late on payments should consider strategic default for private student loans; but the lack of payment options and high interest rates have made strategic default something that private borrowers are considering regardless of their ability to pay their next monthly payment.