Debt Settlement Negotiation Elevated to a Science

Stop Calls & Letters from Dept Settlement Agencies?

You May Be Able to Settle for a Fraction of the Balance Due.

I have settled millions in unsecured debt since 2009 – I can help.

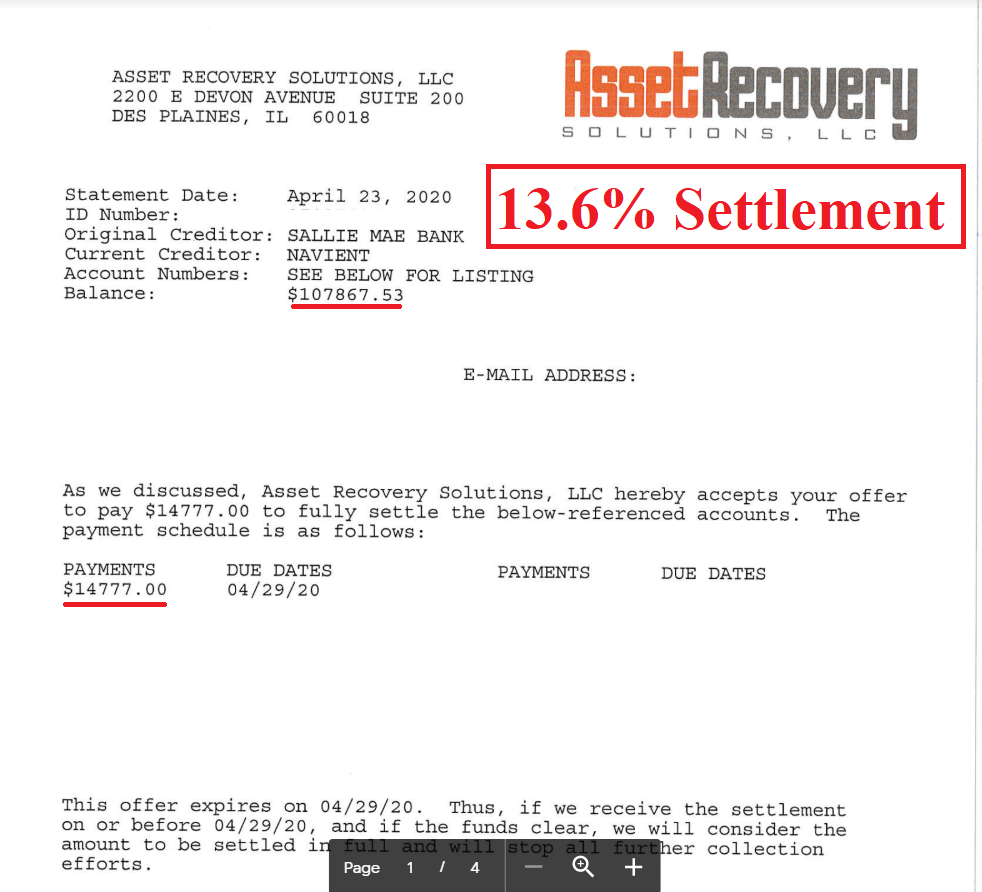

I have high level negotiating relationships that I have built over time with dozens of different debt settlement agencies and debt buyers. This has allowed me to save my clients tens of thousands of dollars, by settling for much less than the balance owed with many different types of accounts.

"In addition to my debt settlement expertise, I specialize in putting an end to harassing phone calls from debt settlement agencies, third-party debt collectors, and debt buyers. With swift action, I can stop these calls within days, and in some cases, even within hours. Your peace of mind is my priority, and I am committed to protecting your rights and privacy throughout the process.

Making sure the debt settlement is “executed” properly after it’s negotiated is just as important as the negotiation itself; and because of my specialized debt settlement payment protocol that I have perfected over my career. With my expertise, you can have full confidence in achieving lasting debt relief.

"All my clients have achieved successful debt settlements without any losses once we execute the agreed-upon terms. I take pride in delivering reliable and effective debt resolution solutions.

The Top Non-Attorney Debt Negotiator

You don’t have to face this on your own Debt Settlement- I’m here to help.

Fast forward to today, and I am even more effective, more experienced, more strategic, with better industry relationships, and have added even more benefits to my service – including a major emphasis on credit recovery (something that is sorely lacking with the vast majority of debt relief companies and negotiators).

Debt Settlement agencies and debt buyers are not operating with your best interests in mind, and are NOT a source of good financial advice. Their only goal is to take as much of your money as possible. Debt settlement agencies routinely lie and make threats that are not true in order to try to scare people into paying. I can help you put an end to their threats and guide you towards achieving a fair debt settlement deal. With my expertise and dedication, I’ll stand by your side throughout the process, ensuring your rights are protected and your best interests are served.

While private student loan settlement is my specialty; over the last 13 years I’ve also settled credit cards, student loan refinances, bank loans, credit union loans, federal student loans (in rare cases only), medical debts, signature loans, FinTech/online lending platform loans, car loans (after repossession), and even a legal bill owed to a criminal defense attorney (definitely one of my most interesting negotiations).

Who Makes a Good Candidate for My Debt Settlement Service?

- Someone who owes $3,000 or more in defaulted unsecured debt.

- Someone who has or can borrow funds to pay for either a lump sum or structured settlement (structured settlements over time are not available with all lenders)

- Someone who has an unsecured debt that was originated with a for profit lender like Navient, Bank of America, Chase, etc (secured loans like mortgages cannot be settled)

- Someone who is ready to take action and get rid of their debt settlement forever.

I am Completely Performance-Based, Which Means that You Only Pay If We Negotiate a Settlement That You Agree To.

"Don't Just Take it From me, Check out What my Past Clients are Saying

“Over the last 13 years, my expertise in debt settlement has encompassed a wide range of financial challenges. I have successfully settled credit cards, bank loans, medical debts, signature loans, FinTech/online lending platform loans, student loans, car loans after repossession, and even a legal bill owed to a criminal defense attorney. With a diverse background and comprehensive understanding of the debt landscape, I am fully equipped to navigate the complexities of your unique situation

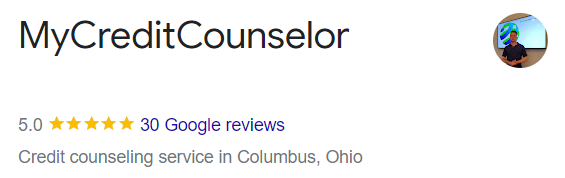

“Don’t just take my word for it; discover what my past clients have to say! As of this writing, I am proud to have received 30 five-star reviews on Google, reflecting the satisfaction and success of those I’ve helped. With a proven track record, I am committed to settling accounts whenever possible. Your financial well-being is my priority, and I strive to deliver outstanding results.

I take on accounts as small as $3,000 and have settled accounts as large as $317,000.

“In the complex world of debt settlement, various scenarios may arise, where Debt Collection Agencies either purchase your debt or are assigned to collect on behalf of the original creditor. While not all lenders may be willing to settle, a significant number do consider it as an option. Don’t navigate this process alone – contact me today for a complimentary evaluation to learn how my expertise can guide you through the intricacies of debt settlement and increase your chances of success.”

READY TO START YOUR JOURNEY

TOWARDS BEING FREE FROM DEBT SETTLEMENT COLLECTORS?

Start by filling out the form below

Enter Your Information For A Free Evaluation

Why Choose Andrew Weber?

Destroy your

balance

I have over 13 years of experienced and have successfully achieved 40-50% on average for settlements, and sometimes lower; settling millions in unsecured debt. I will get rid of your debt for once and for all.

drastically improve your finances

By negotiating reduced settlements on unsecured debt, I will clear the way for you to rebuild your credit, improve your debt to income and debt to credit ratios, and help you create the financial profile needed to get approvals to buy a house, get an auto loan, and refinance federal loans, as well as approval for other credit based lending decisions.

Feel what it's like to be DEBT FREE

Experience the relief of being debt free from loans that never seem to go away or go down. Settling debt is truly a life-changing experience.

Settle your debt before lawsuits occur

I have helped hundreds of borrowers and co-borrowers prevent lawsuits, liens, bank levies, and other forced collection actions on private loans by settling accounts before lawsuits occur. I have never had a client get sued.

I offer a complementary 17 page Credit Building Guide to all clients after debt settlement, and work with one of the best credit repair companies in the US to help delete prior negative payment history after the settlement is completed. We also make sure that all credit reporting is properly updated so you can begin to move on with your life once the settlement is done.

meet andrew weber

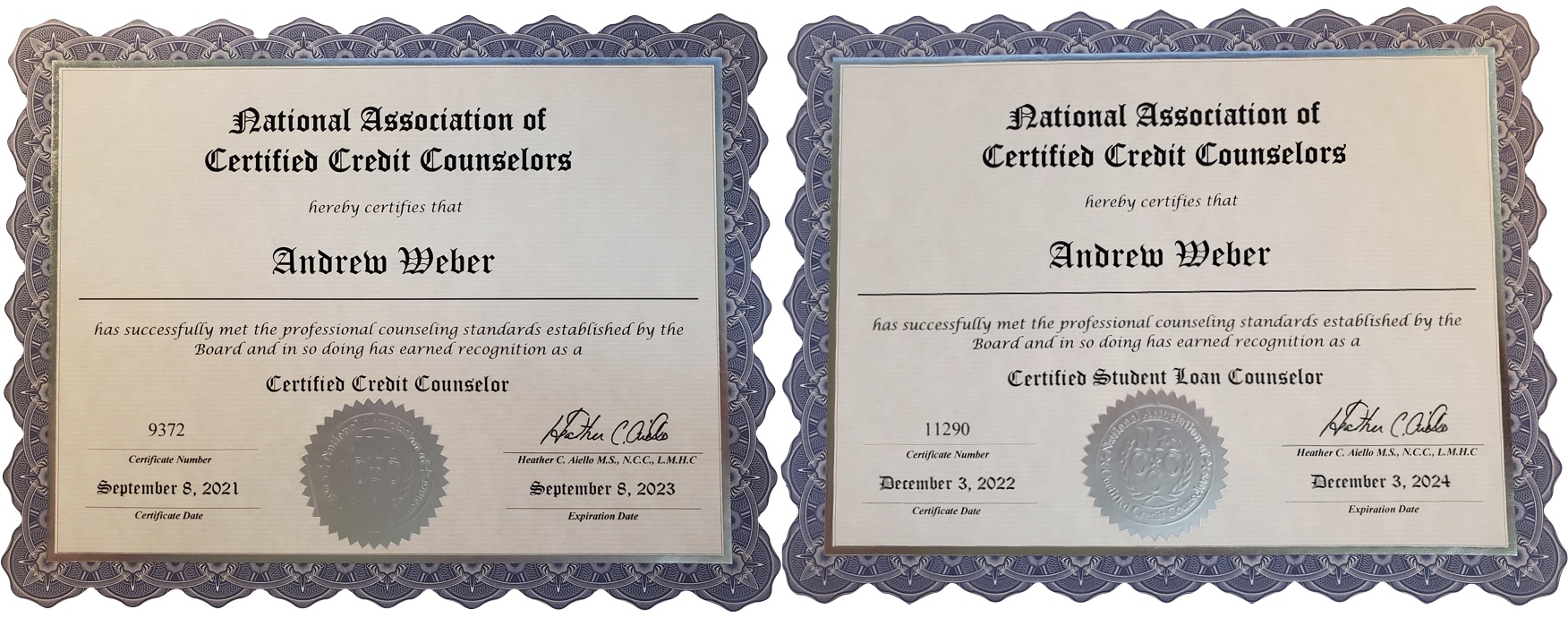

Certified Credit Counselor & Student Loan Negotiator Andrew Weber, Backed by Experience

I’m a NACCC Certified Credit Counselor and a NACCC Certified Student Loan Counselor who has helped over 2,500 borrowers. My financial advice has been featured in Forbes Magazine, The New York Times, CBS News, US News and WorldReport, Time/Money, Yaho Finance,Nerdwallet, Credit.com,

AARP.com and The Christian Science Monitor.