Navient Private Student Loan Negotiator

Click to Receive a Free Private Student Loan Evaluation

The Science of Navient Student Private Loans Negotiation

Are you struggling with Navient private student loans?

- Are your Navient private Student loans in default, and hurting your credit?

- Are you current, or a few months behind, and dealing with rising interest rates and high payments of your Navient private student loans?

- Maybe you’re a cosigner, who feels stuck with these loans like Navient Private student loans?

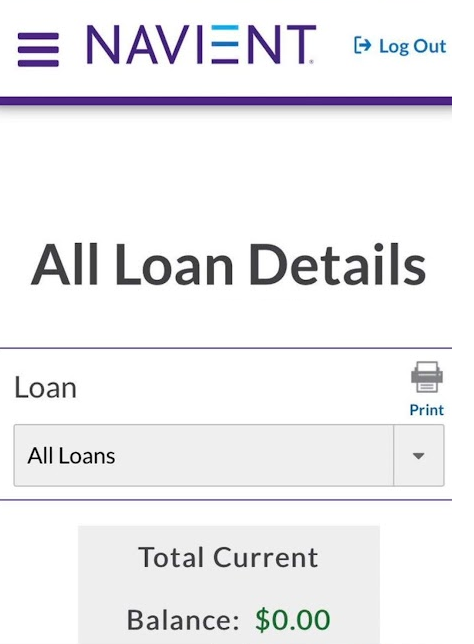

Whatever your situation, I can help you find the right path to a $0 balance!

Click to Receive a Free Private Student Loan Evaluation

Check out my advice, settlement examples, and reviews on social media:

Private Loan Settlement Appears To Be Tax Exempt For A Limited Time!

Worried about being taxed on the savings with a 1099-C? Navient doesn’t seem to be issuing them right now – IRS guidelines resulting from the American Rescue Plan dictate that private loan cancellation is tax-exempt from 2021 until 2025.

Take advantage of private loans settlement tax exemption before it expires! Navient Private student loans, for example, may be tax-exempt.

Navient private student loans will never be forgiven by the federal government, and the Navient Attorney General Lawsuit cancellation has already been processed for those rare few (2% of Navient private student loans borrowers) who qualified.

However, you still have a historic opportunity to get a large part of your Navient private student loans wiped out, without having to worry about a tax bill.

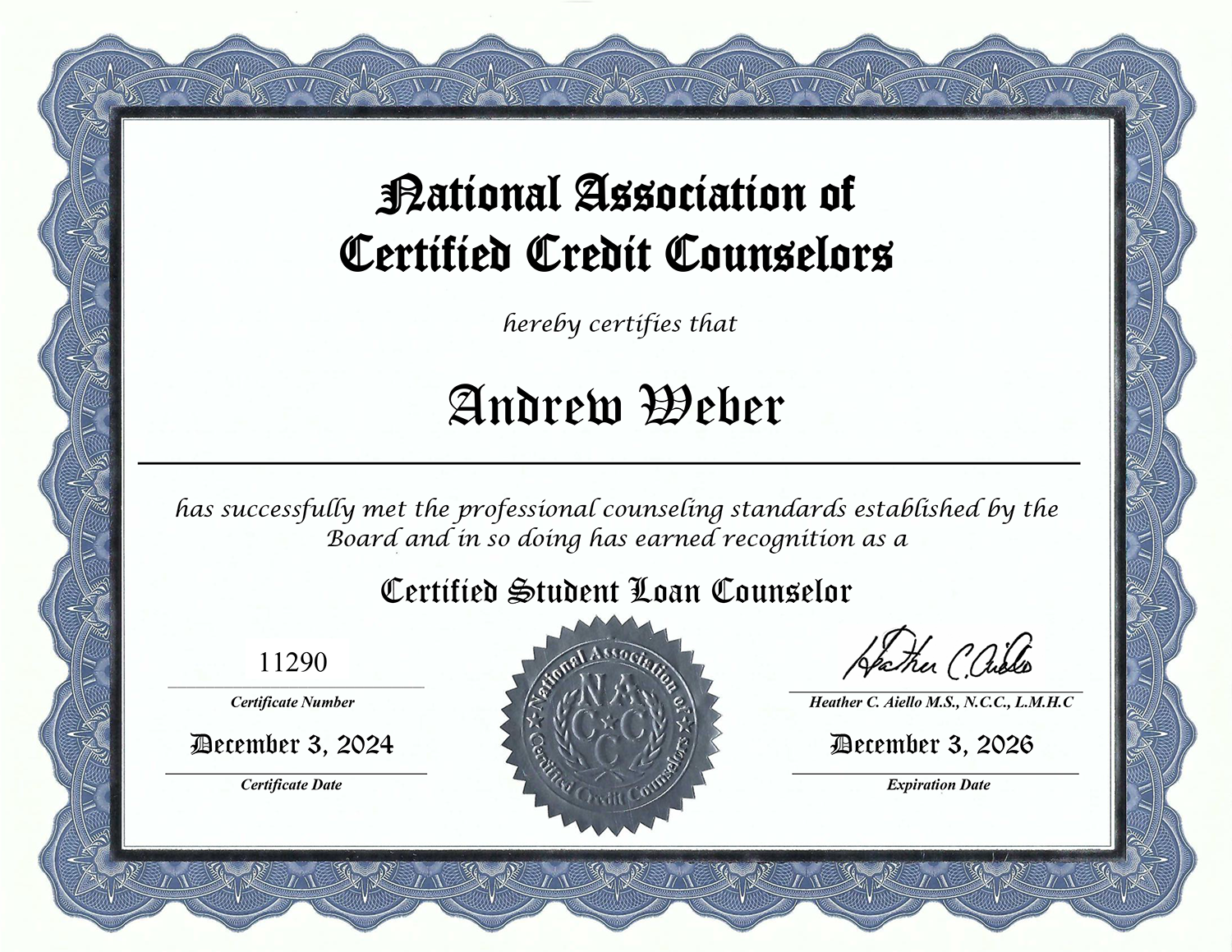

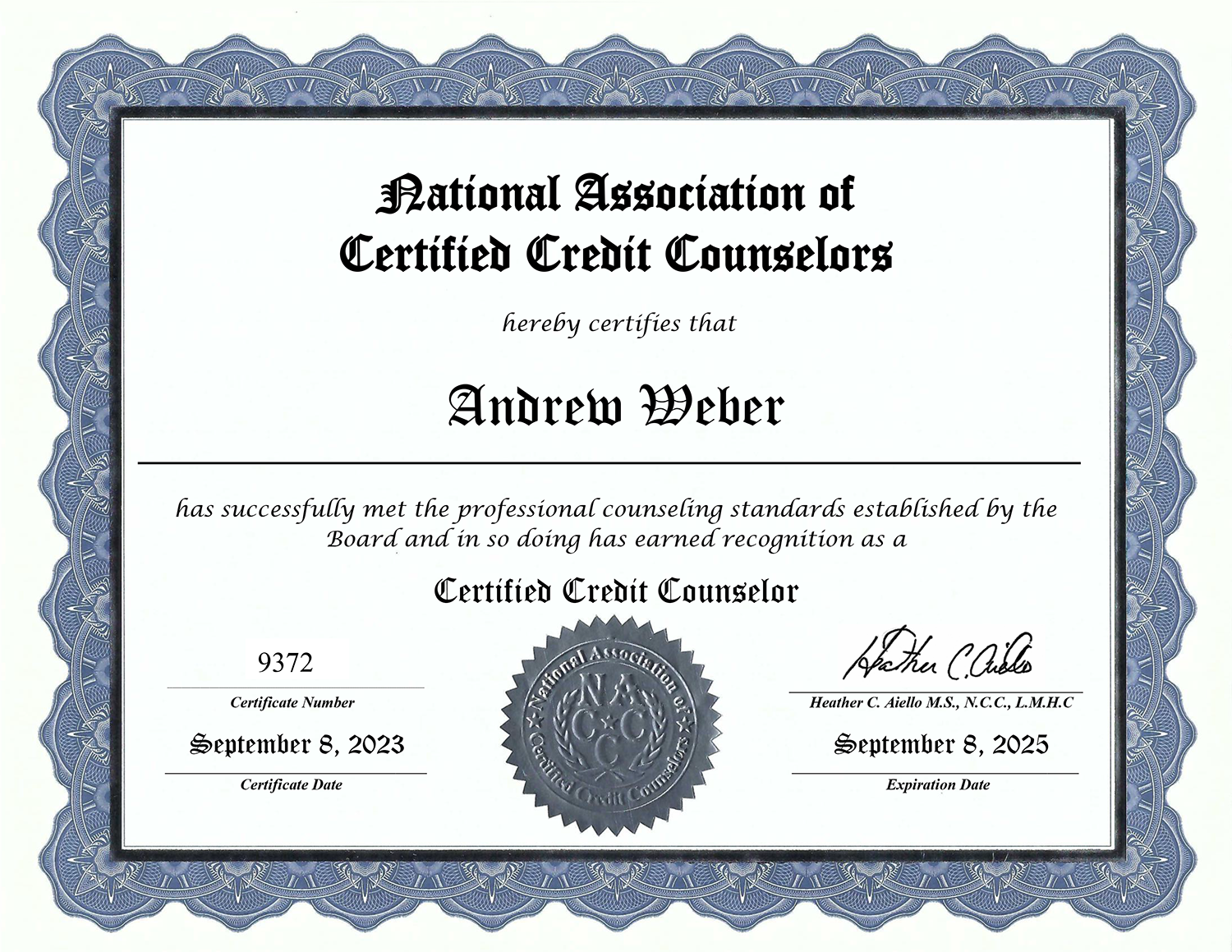

“I’m a NACCC Certified Credit Counselor and a NACCC Certified Student Loan Counselor specializing in settling high balance, high risk Navient private student loans”

Andrew Weber: The TOP Non-Attorney Navient Debt Negotiator

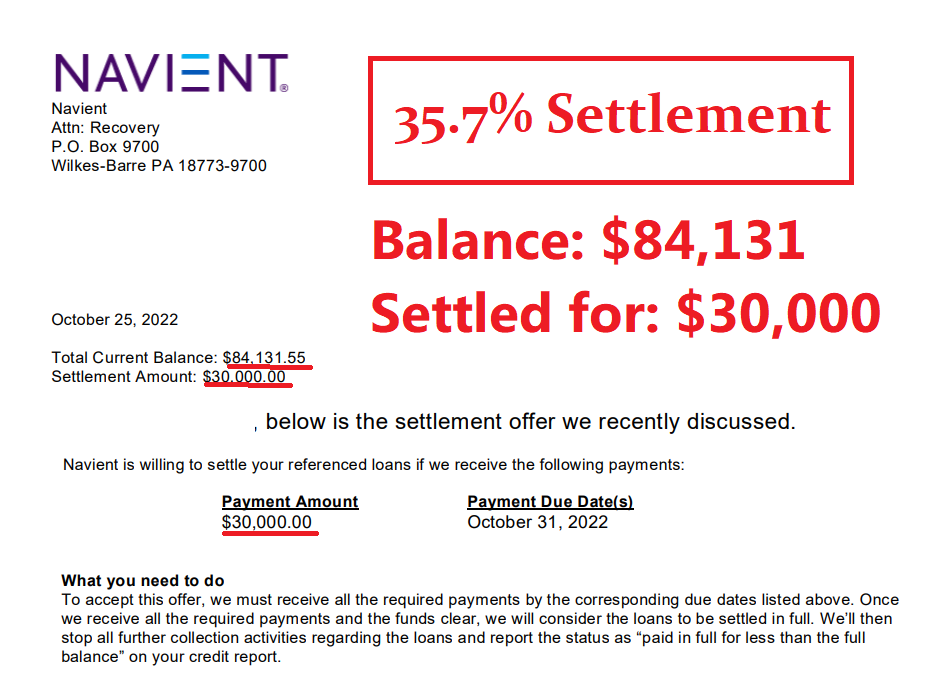

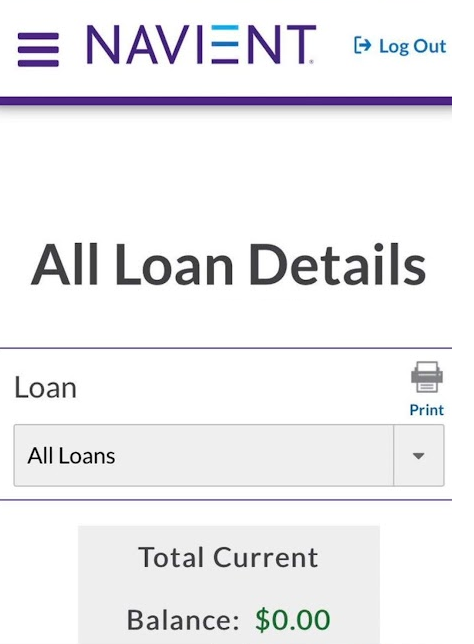

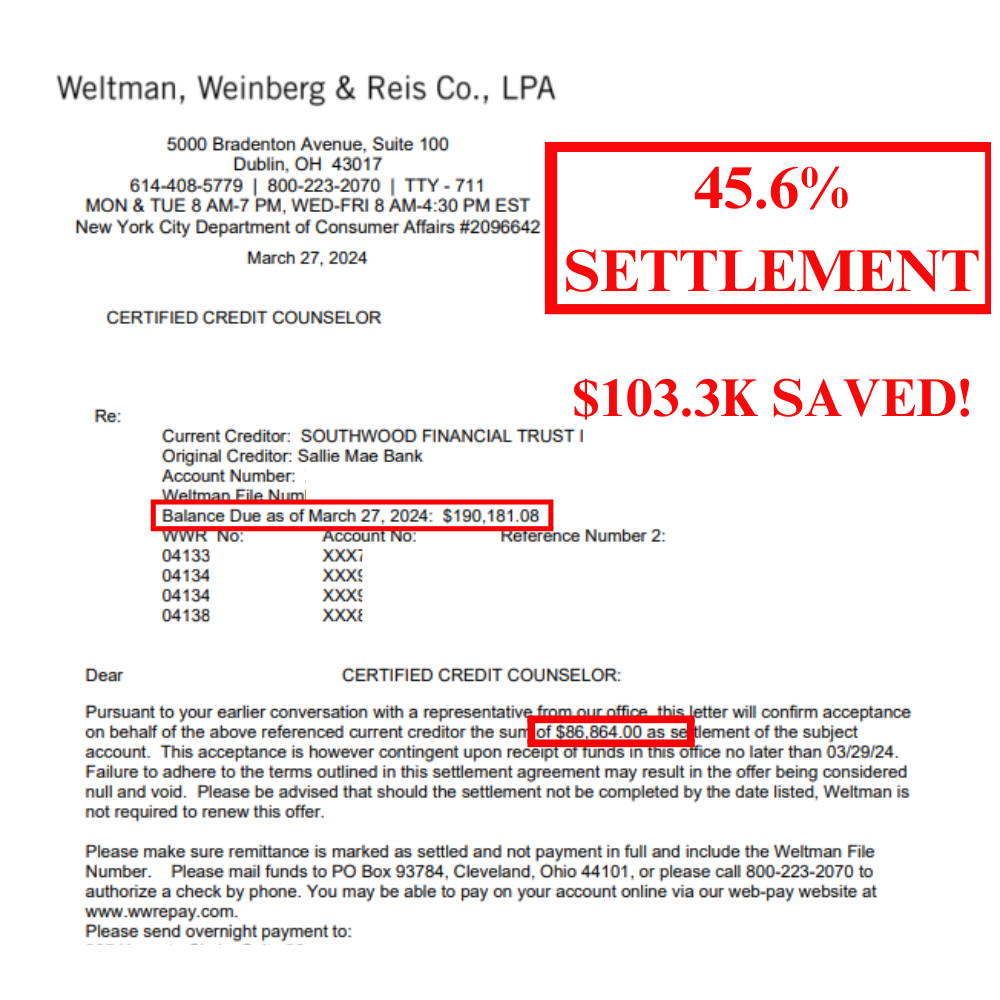

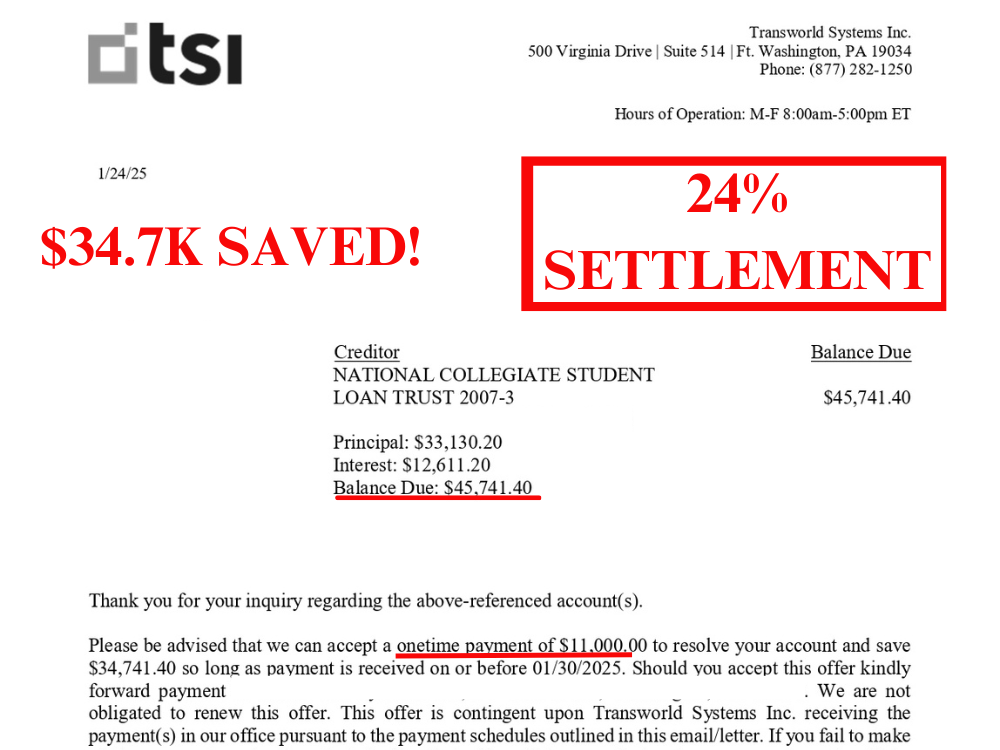

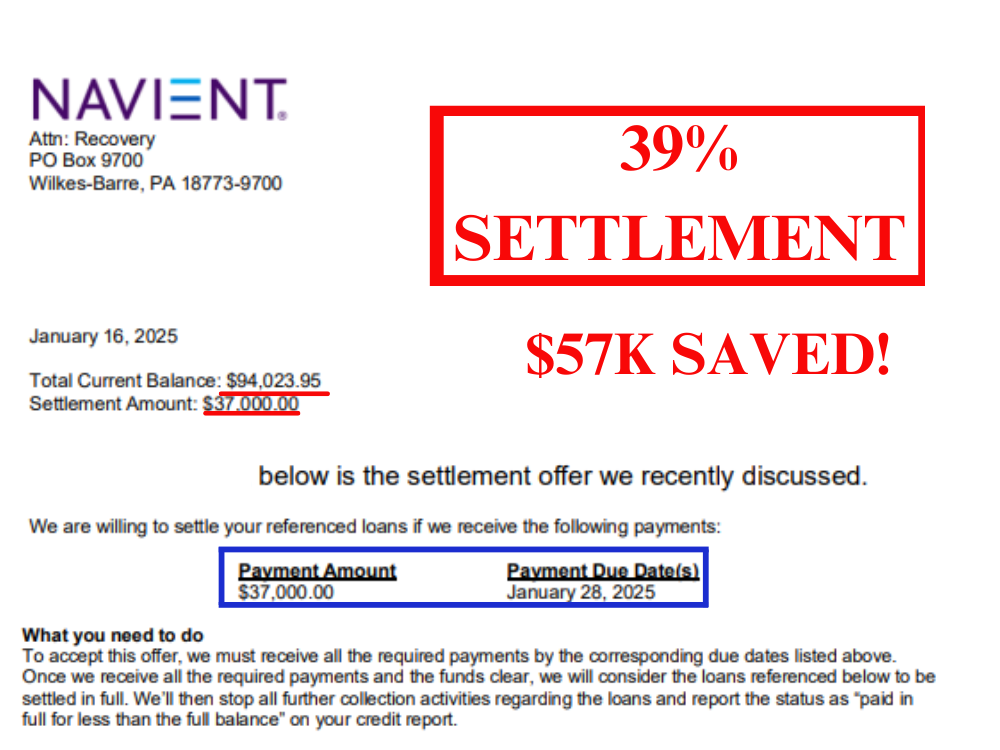

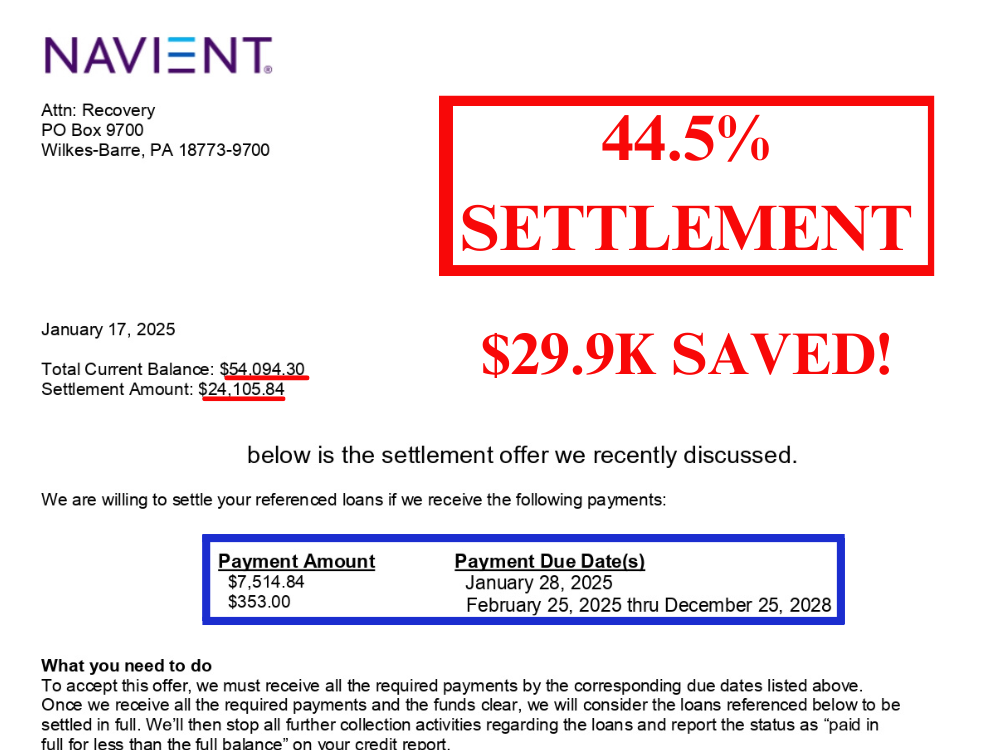

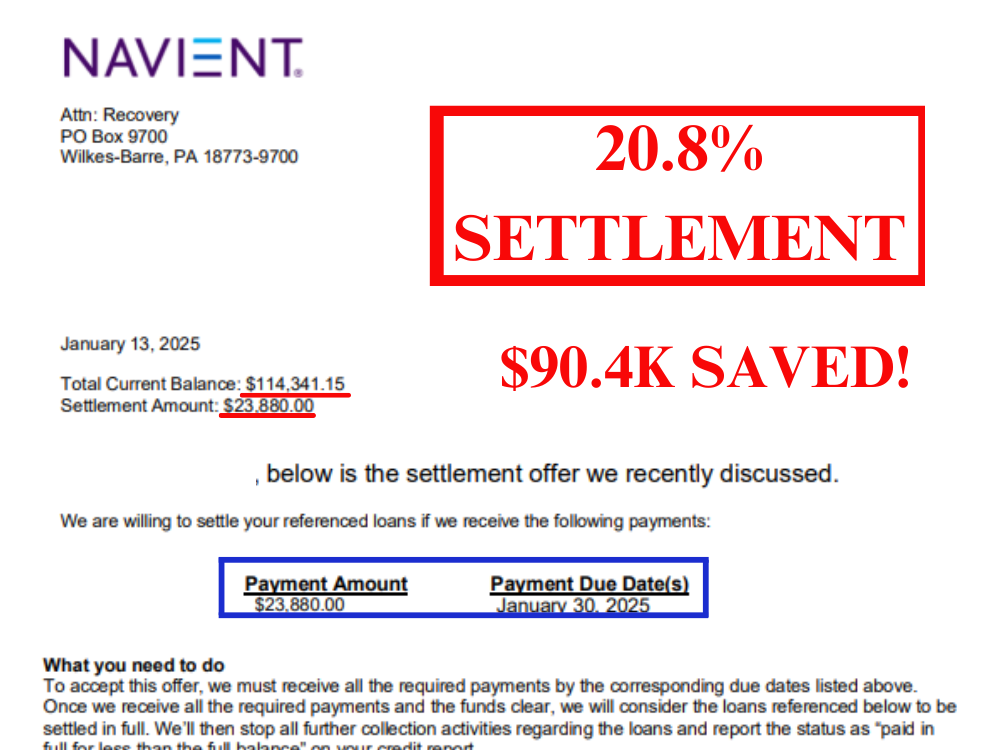

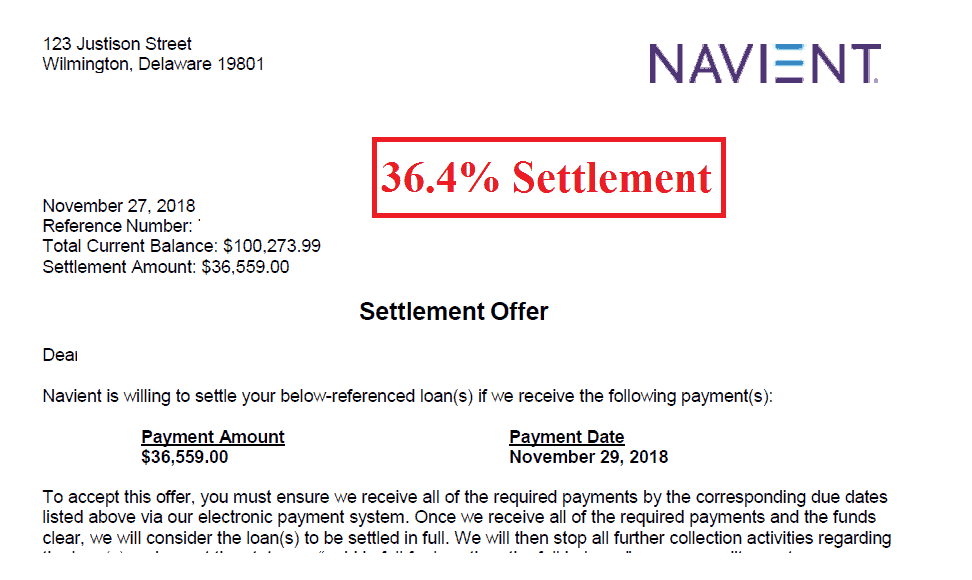

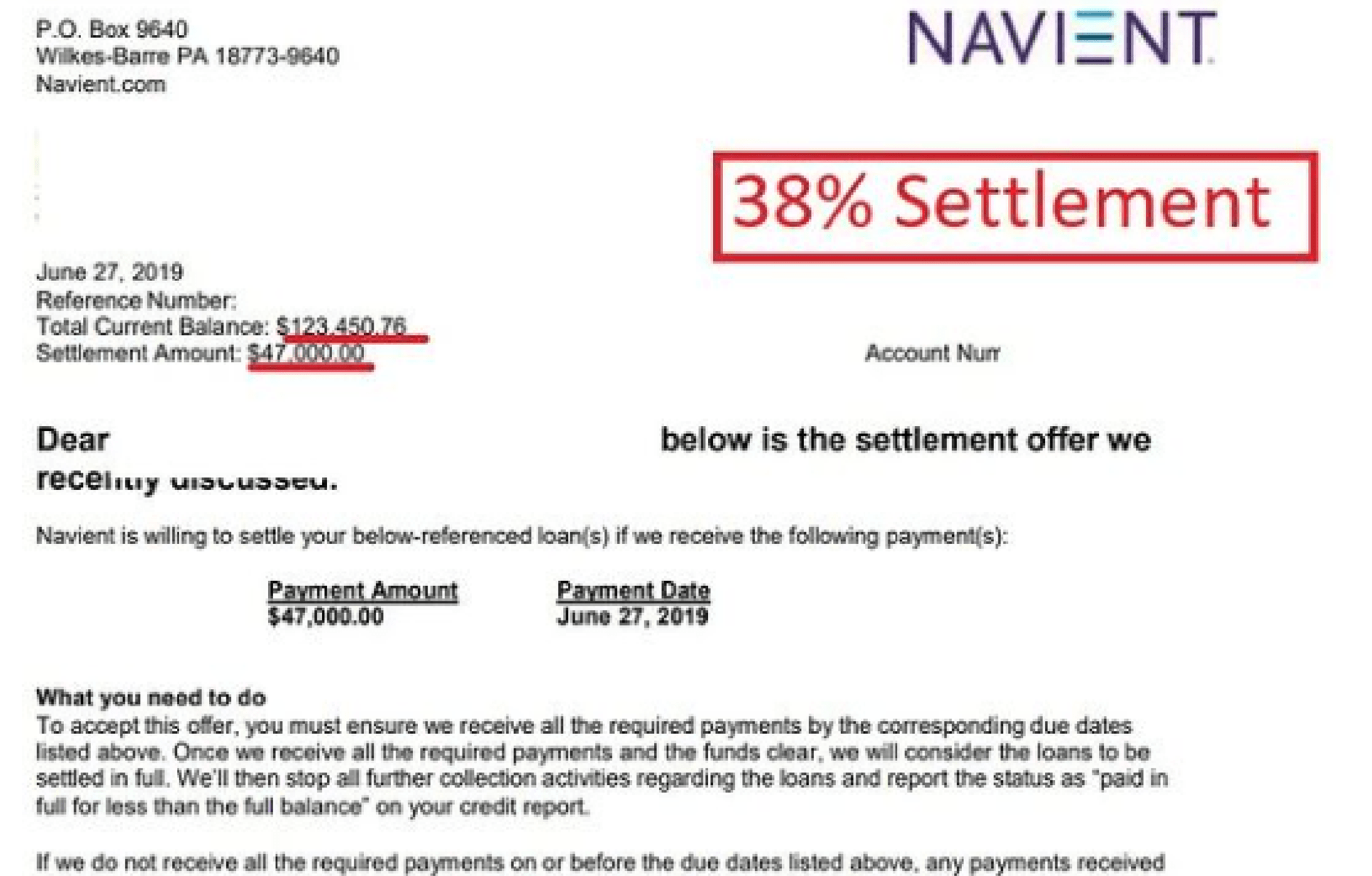

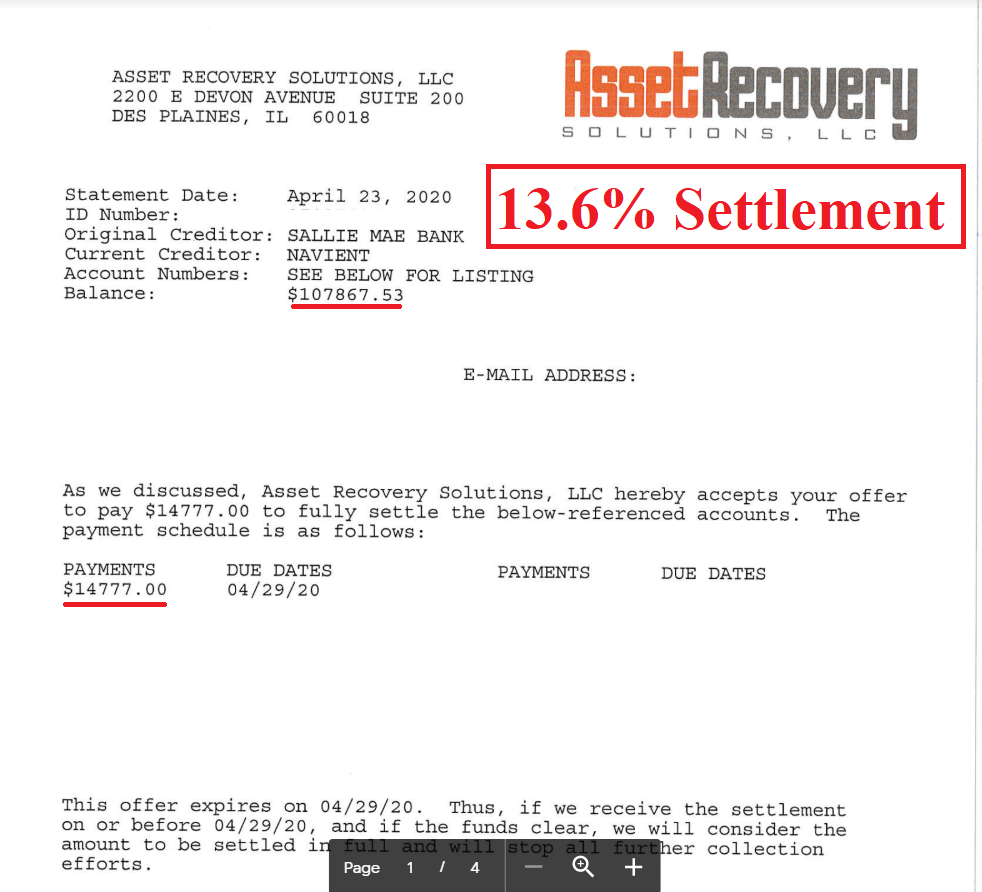

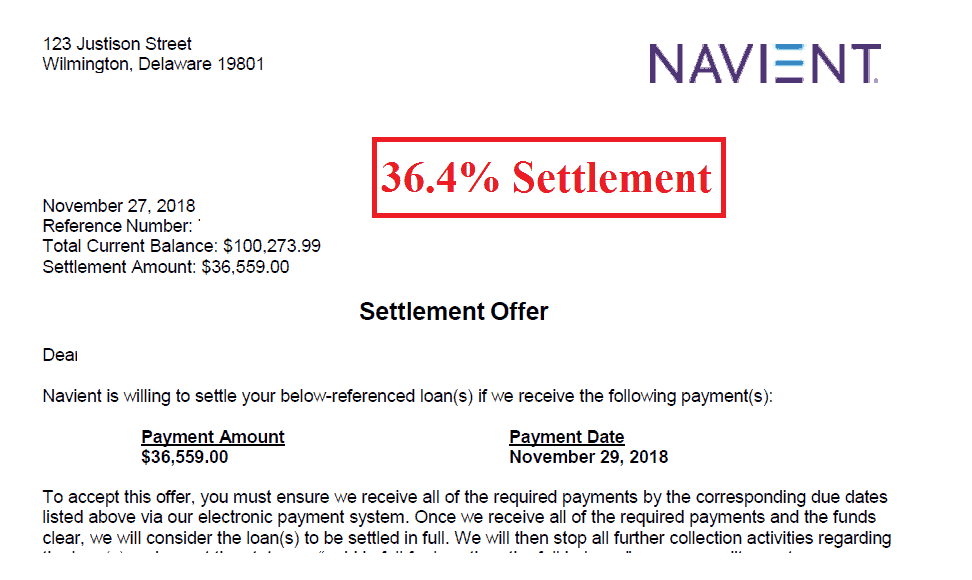

More Successful Navient Settlements

I settled my first credit card debt in 2009, and my first private student loan in 2013 (with Sallie Mae).

I take on accounts as small as $3,000, and as large as $300,000+. Small balances can actually cause big problems for people.

But big balances can cause really big problems, and are much more likely to be targeted for litigation after default (sometimes within a matter of months).

My philosophy is to minimize this legal risk, and minimize the amount of time that credit scores are damaged; while maximizing savings.

Navient loans have to be in default in order to be settled for a significant reduction.

Credit scores bounce back within a year or less after settlement in most cases, and Debt to Income (DTI) improves immediately after settlement.

Settlement itself is the first positive movement for credit scores – the damage comes from the preceding late hits and default notation.

These can sometimes be removed with expert credit repair, but the damage from them fades over time even without that.

I also provide a 17-page comprehensive Credit Building Guide for all clients post-settlement.

What to know about settling with Navient

My Experience

I’ve been negotiating with Navient ever since they were split from Sallie Mae in 2014.

Fast forward to now, and I still negotiate low Navient settlements on a monthly basis. This serves as a testament to my expertise in this field, assuring you that I am fully equipped to assist you with any inquiries or issues you may have regarding your Navient Private student loans.

With this experience and the negotiation relationships I have built within various departments at Navient, I’m able to get spectacular results for my clients – consistently.

Settlement

Settlement is the only real form of significant cancellation relief that is available to the vast majority of Navient private loan holders such as Navient Private Student Loans.

Navient Today

Navient is now almost exclusively a private student loan servicer after transferring their federal loan servicing contract to Aidvantage/Maximus.

If you still have loans serviced by Navient – they are likely private and being handled by Mohela.

While they will not qualify for any government forgiveness, they can be settled for a fraction of what’s owed – with the right negotiation tactics and strategic planning.

Default

If you’re current on payments, strategically defaulting is not always a walk in the park, but I try to take on as much of the burden as I can while guiding you through the process step by step.

If you’re already further behind or in default, the most difficult part of the process is already behind you – dealing with all the calls and letters.

AG Lawsuit

The Navient Attorney General Lawsuit Settlements were very narrow in scope, only affecting 2% of Navient’s private loan portfolio – and they have already been processed.

If you did not receive a letter by the end of the summer of 2022, you likely did not qualify for the narrow requirements for the Navient Attorney General Lawsuit cancellation.

My Role

I will handle all negotiations and communications with Navient, get calls to stop after default, and make sure all credit reporting is updated properly to show that $0 balance – the thing that makes it all worth it.

“My approach is entirely performance-based, ensuring you only pay when we successfully negotiate a settlement that meets your approval.”

Don’t Just Take it From me.

Check out What my Past

Clients are Saying.

Click above to read our reviews!

My Experience Is Key.

Over the last 14 years, I have settled credit cards, bank loans, medical debts, signature loans, FinTech/online lending platform loans, student loans, car loans after repossession, and even a legal bill owed to a criminal defense attorney.

Don’t just take my word for it, check out what my past clients are saying! As of this writing, I have 62 5-star reviews on Google. If an account can be settled, I will settle it.

I take on accounts as small as $20,000 and have settled accounts as large as $317,000.

TOWARD BEING DEBT FREE?

Enter Your Information For A Free Evaluation

Why Choose Andrew Weber?

Destroy your balance

drastically improve your finances

Feel what it’s like to be DEBT FREE

Settle your debt before lawsuits occur

I offer a complementary 17-page Credit Building Guide to all clients after settlement, and work with one of the best credit restoration companies in the US to help delete prior negative payment history after the settlement is completed. We also make sure that all credit reporting is properly updated so you can begin to move on with your life once the settlement is done.

meet andrew weber

Certified Credit Counselor & Student Loan Negotiator Andrew Weber, Backed by Experience

I’m a NACCC Certified Credit Counselor and a NACCC Certified Student Loan Counselor who has helped over 2,500 borrowers. My financial advice has been featured in Forbes Magazine, The New York Times, CBS News, US News and WorldReport, Time/Money, Yahoo! Finance, Nerdwallet, Credit.com, AARP.com and The Christian Science Monitor.

Ready to start your journey toward being debt-free?

Click to Receive a Free Private Student Loan Evaluation