Meet the Team

Meet Andrew Weber

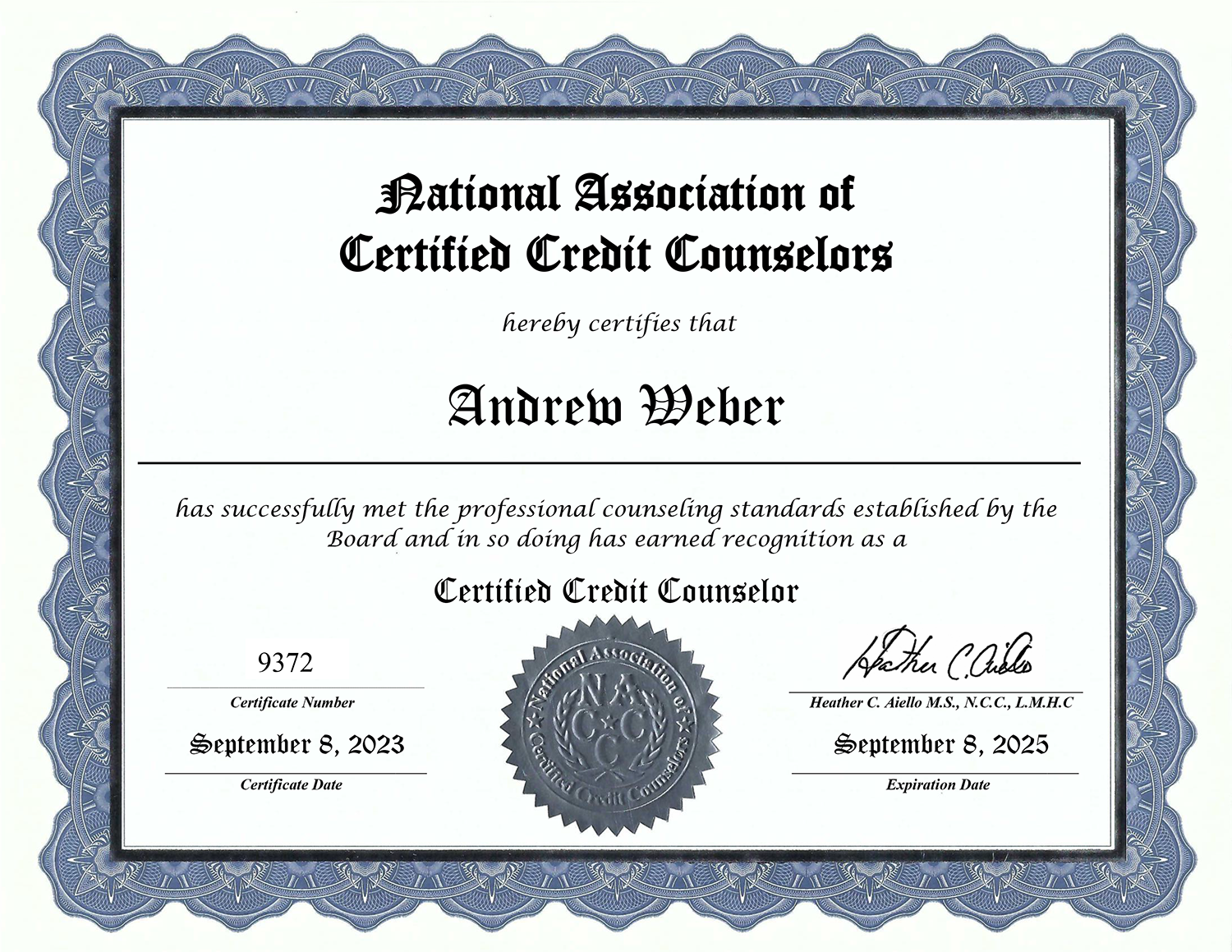

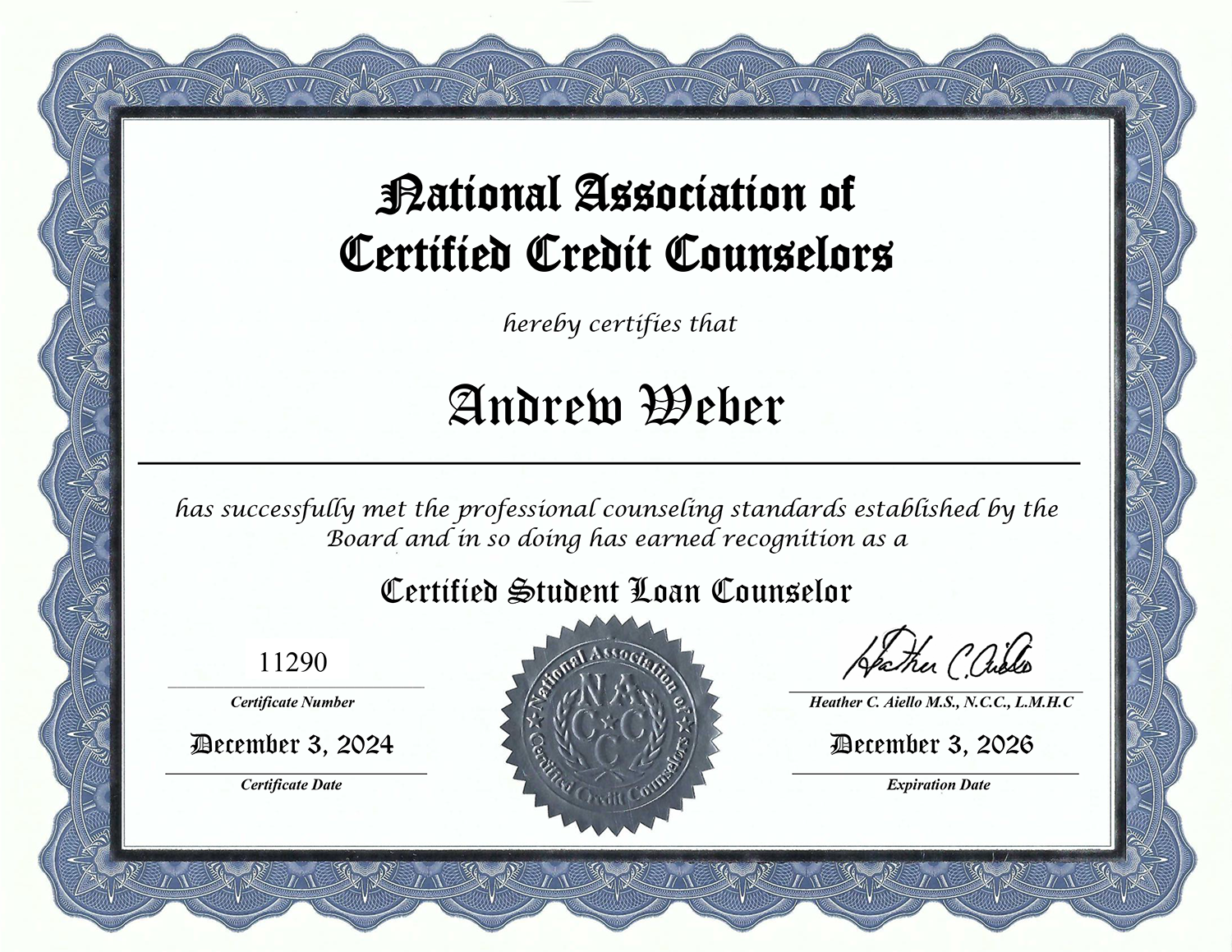

Student Loan Specialist, Debt Negotiator, Certified Credit Counselor, Certified Student Loan Counselor

I’m a NACCC Certified Credit Counselor and a NACCC Certified Student Loan Counselor who has helped over 2,500 federal and private student loan loan borrowers. I am now the only Certified Student Loan Counselor who focuses exclusively on private student loan issues in the US, as far as I’m aware.

My student loan advice as a certified credit counselor has been featured in Forbes Magazine, The New York Times, CBS News, US News and World Report, Time/Money, Yahoo Finance, Nerdwallet, Credit.com, AARP.com, and The Christian Science Monitor.

Click to Receive a Free Private Student Loan Evaluation

Ken Abbas

Assistant Counselor

Ken Abbas has been in the financial industry for 7 years, working in debt collection, credit repair, law firms, and debt settlement firms. He has earned a reputation for his strategic insights, comprehensive evaluations, and a client-first approach.

Frustrated with the many flaws of traditional “old school” debt settlement companies, Ken joined the MyCreditCounselor team, whose values and evolutionary approach to debt negotiation align with his values and mission to help as many people become debt-free as possible.

Accreditation

How My Debt Negotiation Journey Began

Unexpected Detour

Much to my surprise, I found the work very interesting and threw myself into learning as much as I could about debt, credit, and negotiating. I was a bit nervous for my very first negotiation, but I had the bug – the excitement and high stakes of debt negotiation had gotten me hooked.

Climbing the Ranks

When I took that position in 2009, I settled over $550,000 in credit card accounts within a 3 month period. I had a 3 hour daily roundtrip commute via train, car, bus, and walking; and after another 3 months of that grueling routine, I realized I was starting to get burned out.

Realizations

This was typical of the “traditional” debt relief industry, especially before the no-upfront fee rules were put into place by the FTC in 2011. I began working on my own ideas for a more efficient, focused, and effective debt settlement model.

Breaking Out

Two years later in 2011, I became a certified credit counselor and began working on my own – my first client had over $250k in credit cards that he had used to (unsuccessfully) invest in rare coins.

The coins’ value tanked after he bought them, and he found himself in major trouble with 15+ credit cards (I settled all of them successfully).

Two years after that, after getting some advice from one of the best student loan attorneys in New York; I settled my first private student loan with Sallie Mae (the collector I negotiated it with still works there, and I still work with him to this day).

Today

Over the years I have developed high level contacts at the largest private loan lenders, collection agencies, and attorney collection firms – working with everyone from front line collection agents, to the vice presidents of collection agencies – and everyone in between.

I even save a file of all of my negotiation contacts over the years – it now has over 100 contacts in it. This allows past negotiation success to build on future efforts. An established relationship makes a world of difference.

If you have a debt other than a private student loan, visit my Other Debts page.

Ready to start your journey toward being debt-free?

Click to Receive a Free Private Student Loan Evaluation