Do you have a NaviRefi loan? Or maybe you have a Navient private student loan, and have been contacted through the NaviRefi department. Or, maybe you have a different type of student loan and are wondering if you can refinance with them.

![]()

For those who currently have NaviRefi loans – they can be settled for a fraction of the balance, which I will get to later in this article. If you’re considering refinancing a Navient private loan with them – they aren’t terrible, but there may be better options out there. If you’re considering refinancing a federal student loan into a private loan with them – that is probably not the best idea right now.

It’s important to understand that NaviRefi is an internal refinance division within Navient, that is only open to existing Navient borrowers. This is a private loan refinance process – if you have a federal student loan, going through NaviRefi would convert it to private (which is not recommended for the majority of federal student loan borrowers, especially with federal loan forgiveness still up in the air). Very few federal loan borrowers still have loans with Navient after they transferred their federal loan servicing business, so chances are, your Navient loan is privately backed.

Navient got into some trouble recently for promoting their NaviRefi process to federal student loan borrowers during the pandemic payment pause (before they transferred their federal loan servicing contract). While there are disclaimers on their website about refinancing federal loans; like many refinance lenders, NaviRefi does not fully disclose all the risks and downsides that come with refinancing a federal student loan into a private student loan.

Yes – you will get a lower interest rate – but for federal loan borrowers, you will lose all access to federal relief options such as forgiveness plans and income driven payment plans. Again – this is not so much of a concern now that most of Navient’s federal loan portfolio was transferred to another servicer.

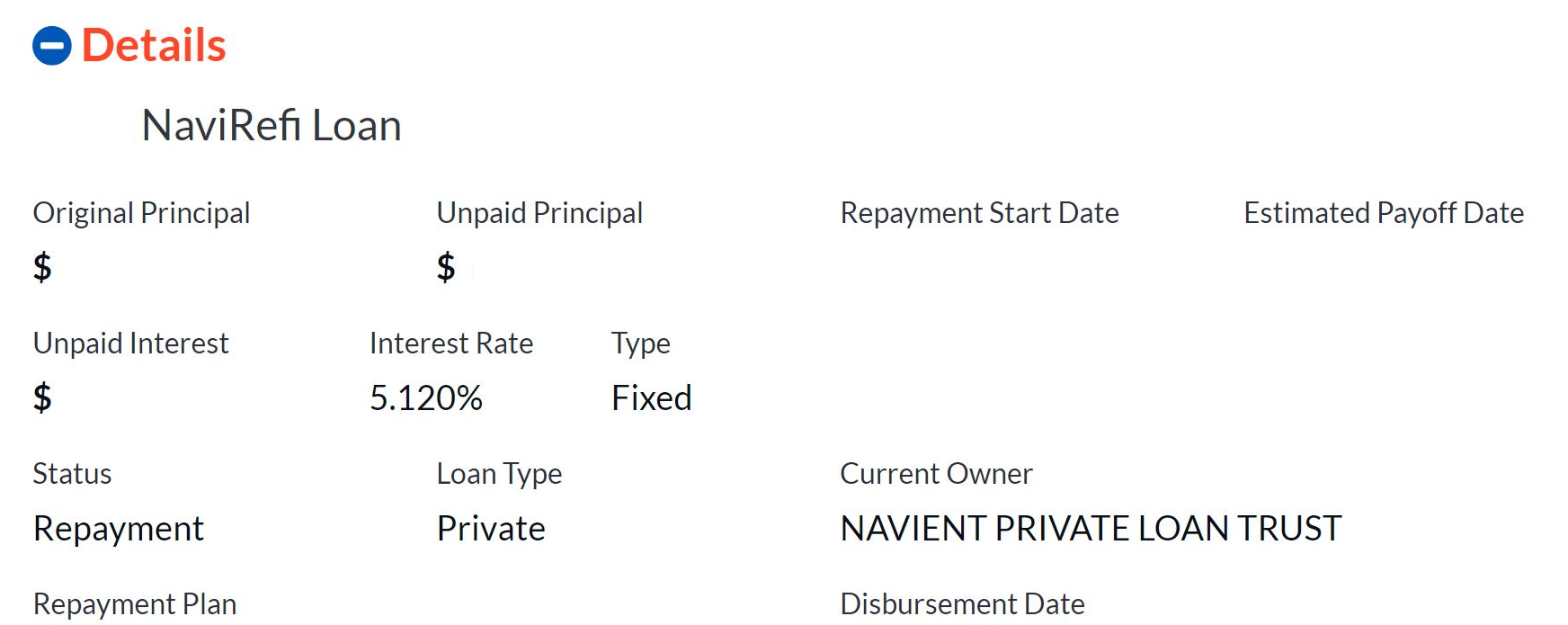

For those who have private student loans already with Navient, there’s no harm in refinancing them internally with NaviRefi, and it will probably be a pretty easy process because they already have all of your information. The main benefit to this process is getting a lower interest rate (rates tend to be around 4-5%), and it may also lower your monthly payments as well. However, you will still be paying the full balance plus interest over time.

There are no origination fees, and they are also available to Navient borrowers who did not finish their degree (which can be an obstacle for other refinance lenders).

Some of the downsides to refinancing with them are:

- They require a hard credit pull

- No cosigners are allowed which may limit eligibility for those with low credit or income

- It is only available if you already have a loan with Navient

- Navient is pretty well known for less than stellar practices and customer service

One of the main benefits to using this type of refinance is that you preserve your ability to settle for less than the full balance in the future. For all of the negatives associated with Navient, with expert negotiation they can be settled for less than 50% of the balance in many cases. Most of my settlements range from 30-40%, or even lower for accounts that have been in default for a longer period of time.

Since this refinance process keeps the loans with Navient, they are handled just like any other private loan that they hold. For other refinance lenders, it may be much more difficult to settle for anything close to this range. For example, Citizens Bank also offers private student loan refinance, and in my settlement negotiations with them it has been an all out battle for many months, just to get them anywhere close to 50-55% of the balance.

I can also negotiate Navient or NaviRefi settlements out over a 4-5 year term if needed – longer than most other lenders – but settling in a shorter timeframe, or with a lump sum, is always recommended.

Credit will recover faster, and we can usually save more with a “lump sum” settlement versus a “structured” settlement over time.

To conclude – NaviRefi is not a bad option for those with Navient private loans who want to cut down their interest rate and still keep the option of settling at a future time through strategic default.

For those with Navient loans who want a more aggressive option and would rather go right to the settlement process – there’s no need to go through a refinance first.

For borrowers that aren’t able to come up with funds for settlement, this can still be a way to get a break on the interest rates and interest accrual, even if you don’t have the funds to settle for a fraction of the balance. of your NaviRefi loans.