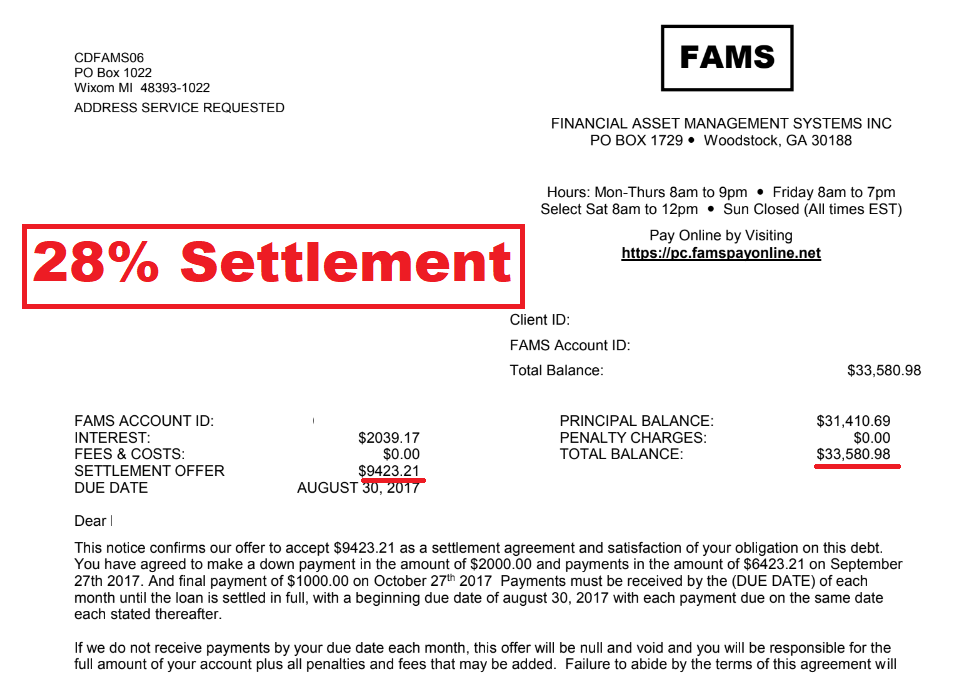

Financial Asset Management Systems Debt Settlement

Click to Receive a Free Private Student Loan Evaluation

Debt Settlement Negotiation Elevated to a Science

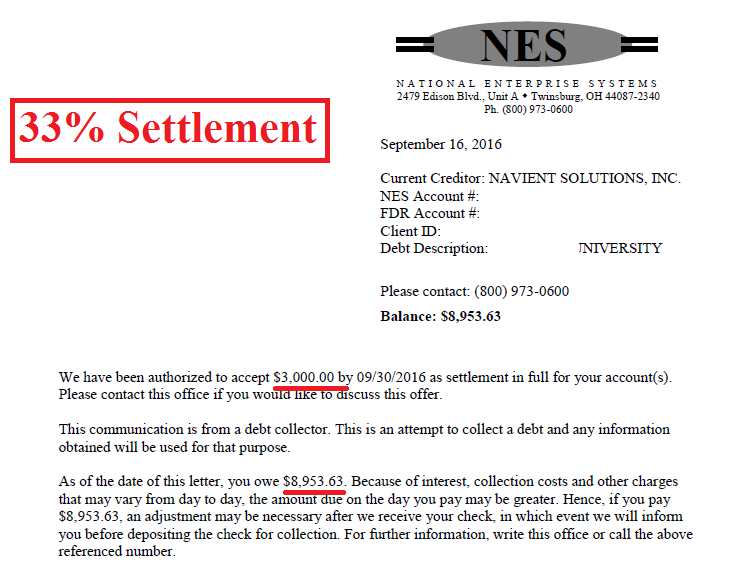

Stop Calls & Letters from National Enterprise Systems.

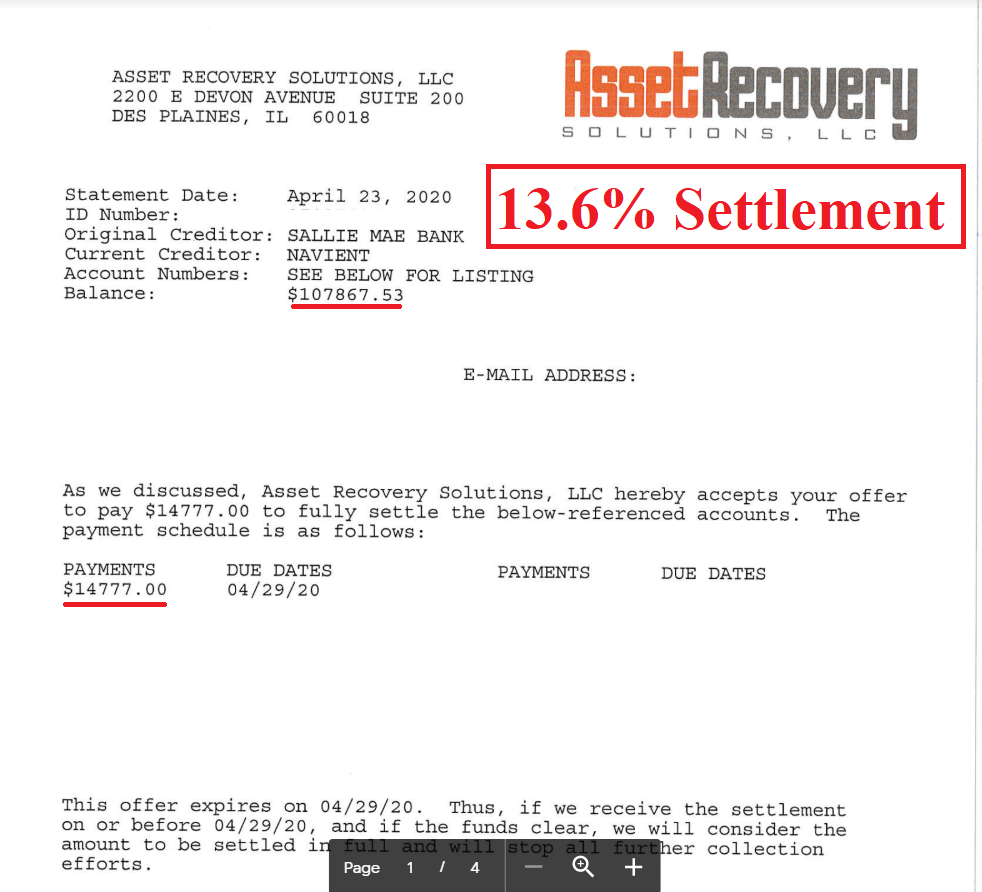

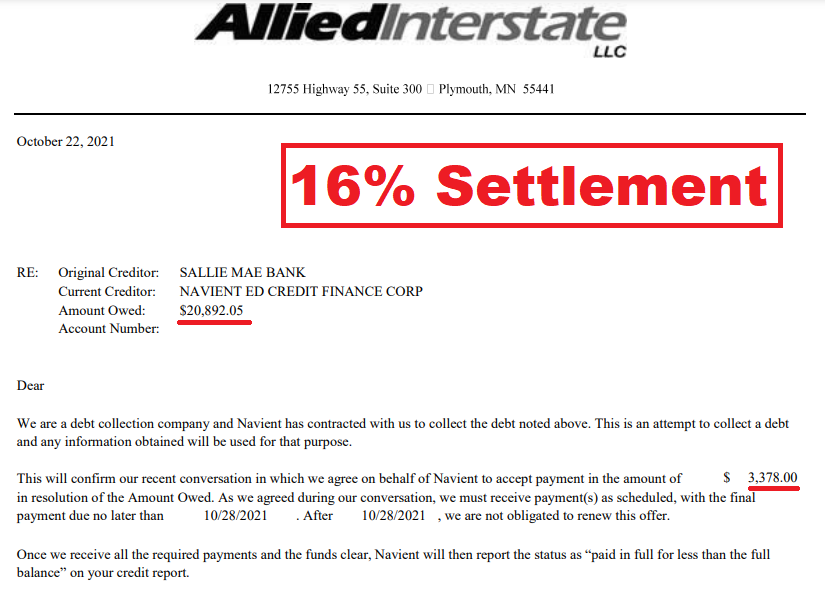

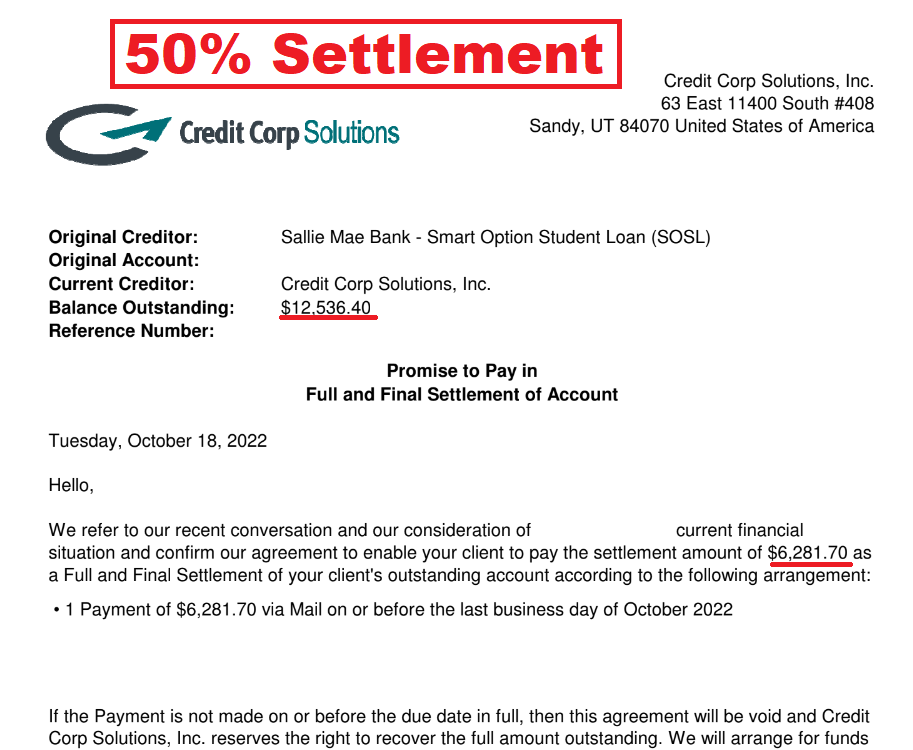

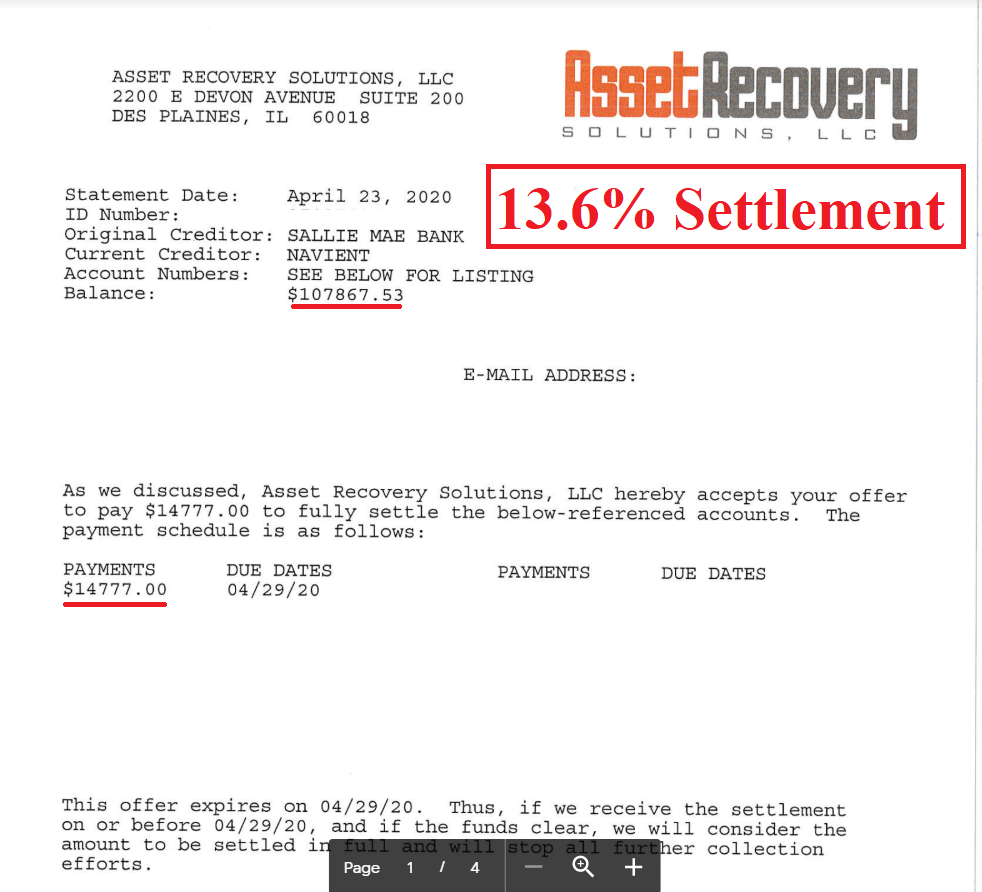

You May Be Able to Settle for a Fraction of the Balance Due.

Andrew Is Your Certified Credit Counselor

Making sure the settlement is “executed” properly after it’s negotiated is just as important as the negotiation itself; and because of my specialized settlement payment protocol that I have perfected over my career.

“I have never had a client lose a settlement after we execute it.”

Andrew Weber: The TOP Non-Attorney Debt Negotiator

In 2011, I was certified as a credit counselor and began working on my own – my first client had over $250k in credit cards that he had used to (unsuccessfully) invest in rare coins. The coins’ value tanked after he bought them, and he found himself in major trouble with 15+ credit cards- I settled all of them successfully.

You don’t have to face this on your own – I’m here to help.

Fast forward to today, and I am even more effective, more experienced, more strategic, with better industry relationships, and have added even more benefits to my service – including a major emphasis on credit recovery (something that is sorely lacking with the vast majority of debt relief companies and negotiators).

While private student loan settlement is my specialty; over the last 13 years I’ve also settled credit cards, student loan refinances, bank loans, credit union loans, federal student loans (in rare cases only), medical debts, signature loans, FinTech/online lending platform loans, car loans (after repossession), and even a legal bill owed to a criminal defense attorney (definitely one of my most interesting negotiations).

Who Makes a Good Candidate for My Settlement Service?

- ZSomeone who owes $3,000 or more to Credit Corp

- ZSomeone who has or can borrow funds to pay for either a lump sum or structured settlement (structured settlements over time are not available with all lenders)

- ZSomeone who has an unsecured debt that was originated with a for profit lender like Navient, Bank of America, Chase, etc (secured loans like mortgages cannot be settled)

- ZSomeone who is ready to take action and get rid of their debt forever.

“My approach is entirely performance-based, ensuring you only pay when we successfully negotiate a settlement that meets your approval.”

Don’t Just Take it From me.

Check out What my Past

Clients are Saying.

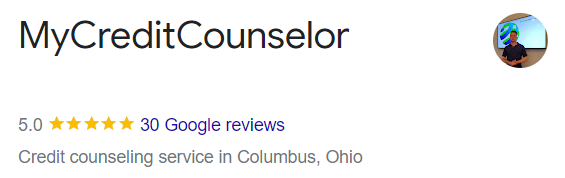

Click above to read our reviews!

My Experience Is Key.

Over the last 13 years, I have settled credit cards, bank loans, medical debts, signature loans, FinTech/online lending platform loans, student loans, car loans after repossession, and even a legal bill owed to a criminal defense attorney.

Don’t just take my word for it, check out what my past clients are saying! As of this writing I have 30, 5 star reviews on Google. If an account can be settled, I will settle it.

I take on accounts as small as $3,000 and have settled accounts as large as $317,000.

In some cases, Credit Corp Debt Settlement may have bought your debt, in others – they are just assigned to collect on behalf of the original creditor. Not all lenders settle, but many do. Contact me today for a free evaluation to learn how I can help.

TOWARD BEING DEBT FREE?

Enter Your Information For A Free Evaluation

Why Choose Andrew Weber?

Destroy your balance

drastically improve your finances

Feel what it’s like to be DEBT FREE

Settle your debt before lawsuits occur

I offer a complementary 17-page Credit Building Guide to all clients after settlement, and work with one of the best credit repair companies in the US to help delete prior negative payment history after the settlement is completed. We also make sure that all credit reporting is properly updated so you can begin to move on with your life once the settlement is done.

meet andrew weber

Certified Credit Counselor & Student Loan Negotiator Andrew Weber, Backed by Experience

I’m a NACCC Certified Credit Counselor and a NACCC Certified Student Loan Counselor who has helped over 2,500 borrowers. My financial advice has been featured in Forbes Magazine, The New York Times, CBS News, US News and WorldReport, Time/Money, Yahoo! Finance, Nerdwallet, Credit.com, AARP.com and The Christian Science Monitor.

Ready to start your journey toward being debt-free?

Click to Receive a Free Private Student Loan Evaluation