The answer to this question first and foremost depends on whether your Navient Loan balances are private, or were federal.

Read the article I wrote here to determine this, if you’re unsure.

It’s pretty tough to negotiate federal student loans with ol’ Uncle Sam through your student loan servicer, but if you have Navient loan – read on to learn about how you can bypass the threats and aggressive behavior; and drastically reduce the amount you owe.

As of this writing, almost all Navient loans are now private – they transferred the majority of their federal portfolio to a company called Aidvantage and for the most part, exited the federal loan servicing industry.

Before I go further – are you looking for information on whether Navient loan has been sued themselves, and what that means for account holders?

Navient Loan was sued by a combined group of state Attorney’s General in the Navient AG Lawsuit (www.NavientAGlawsuit.com). According to one of my contacts at Navient Loan, this affected only about 2% of their private student loan portfolio. If you read the requirements on the website for the AG settlement, they are quite narrow in scope – most people did not qualify.

For those that did qualify, their loan cancellation was already processed during the summer of 2022. If you still have Navient loan for private student, it is highly likely that you are among the 98% of Navient loan borrowers who did not qualify for the narrow relief the AG lawsuit provided.

Prior to this, Navient DE Corporation has been sued by various regulatory agencies since they split off from Sallie Mae Bank in 2014.

The majority of these enforcement actions were against Navient loan company as a federal loan servicer on behalf of the Department of Education; with widespread allegations of violating consumer protection laws.

Sallie Mae was sued quite often prior to becoming an FDIC insured bank, and nothing really came of that either – a slap on the wrist, and a cost of doing business for them. Since they became FDIC insured as an actual bank, they still do originations, but have tried to stay off the radar. Sallie Mae now sells the vast majority of their defaults to debt buyers.Navient Loan Settlement

Beware of scammers who try to imply that there are broad loan forgiveness programs as a result of loan forgiveness lawsuits againt Navient Loan Company. I’ve written more about these types of loan forgiveness scams here. Researching the various investigations and legal actions against Navient Loan Company will probably only make you upset that they are able to get away with so much. Aside from the previous AG settlement, there simply is no meaningful compensation available as a result of any regulatory litigation through state regulators or the federal government – it’s business as usual for them. Consumer advocates have long railed against the lack of compliance by large personal finance companies like Navient and Sallie Mae, but to date the rulings from the suits that have been brought are very limited in their scope of relief.

Navient often got in trouble during their federal loan servicing tenure (which may be partly why they got out of federal loan servicing) when Navient (and formerly Sallie Mae when the violations occurred) was ordered to return $22 million to the Education Department for overcharging as a loan servicer. In effect, this means that Sallie Mae at the time simply got a zero interest $22 million loan, and got away with not paying it for a decade. All they were required to do was return it, without even any late fees or interest.

It is probably long overdue for class action settlements to result in real compensation for a larger percentage of student borrowers, but lenders like Sallie Mae and Navient Loan put a huge amount of resources into fighting these investigations and lobbying the federal government (regardless of administration); rather than strictly complying with consumer protection statutes for their student loan customers.

However, this does not mean that student loan forgiveness is impossible with privately backed accounts through Navient Loan corporation. It just takes a different form than you may expect: debt relief agreements on defaulted debt can be far less than what is owed.

Student loan lenders came up with the idea of reduced sum payoffs in the first place:

It’s important to note regarding student loan debt debt negotiation (with private lenders): that if lenders did not want to settle, they simply wouldn’t. Despite the adversarial process, this is a system that is ultimately created by the lenders themselves. With high interest rates, lenders are calculating that a certain percent of people will default and never pay, or pay a reduced amount; and the high interest rates make sure that they will still turn a profit overall.

While taking a beating in the stock market in 2015, largely due to federal loan practices; in 2014, Navient Loan originated $4.3 billion in private student loans with expected losses of $116 million to $130 million . As a company, Navient expected to lose over $100 million on their private loan portfolio – which seems to be the closest thing to actual Navient private student loan forgiveness. By the way, their total private portfolio is over $8 billion – a pretty good chunk of change. Next to being servicers for the FFEL program; private originations are their second largest portfolio. Since the expected losses are baked into their figures, we can see that Navient loan expects to settle some accounts each year – and expects to not be able to recover on other accounts at all. Personal finance companies that originate education debts have just as much incentive to settle as any other unsecured debt originator. It’s just a matter of how, and when. Financial relief can be available, but you have to fight for it; or better yet, hire someone who is a professional at fighting for it.

Making years of payments without seeing real progress, and seemingly endless threats:

The common refrain that I hear, over and over again, is that despite paying for years; the balance is not going down or may even be increasing over time. Unlike with federal loan servicers, there are no income driven repayment plans available. Forbearance programs are applied liberally, as they know this will cause your account balance to increase, and may even result in a longer repayment term. There is no specific relief for public service workers, or any type of public service loan forgiveness as there is with federal loans (PSLF).

It’s important to understand that Navient’s business model involves you paying multiples of the amount you borrowed.

People understandably feel like they are throwing their money away. And this is just for those that are current – for delinquent or defaulted accounts, navigating a complex web of vaguely threatening calls and letters is the norm.

Customer service representatives say “ Accounts will be ‘terminated’ if a payment isn’t made. “We intend to file a lawsuit against you if no payment is made before charge-off”. “Your Loan account has been escalated to our super duper, last chance, really seriously, for real-for real, no we are completely not joking department”.

The voices coming across the other end of the line are often rude and threatening. The letters are scary, but vague, and look like high ranking directors or vice presidents are personally getting involved with the accounts. Options are limited! Last chance! Call by tomorrow at 5pm, or we will force you to sell your internal organs on the black market.

The calls and language used are intentionally opaque, because the collectors know that playing on a lack of understanding of a particular lenders’ collection cycle -and letting your own imagination collect on the account for them– is a surefire winning tactic. This is not to say that lawsuits don’t occur. They do.

But from my experience, there are many, many opportunities to settle or work out better student loan payments with a company like <span< a=””>>Navient loan or Sallie Mae prior to this happening – and with other private lenders as well. However, the vague threat of legal action is often brought up at multiple times in the collection cycle, and is often the go-to response for a collector who is hard-balling or bluffing on a settlement offer.</span<>

Student loan borrowers are surprised when they attempt to negotiate a student loan (private) debt settlement on their own and are flatly refused, or are denied reasonable payments during this process. And in many cases, they’ve unknowingly given up information about their income or assets that can hurt their chances of settling down the road.

This dynamic is very different than applying for other student loan programs. Negotiating is definitely not like asking for a different payment date or signing up for electronic debit payments – it’s an adversarial process that is not for the faint of heart, and is essentially a renegotiation of the original contract. It can take a long term effort of negotiations – negotiations which will not be successful unless a specific strategy to reach a desired settlement is implemented from the very first call.

Lenders don’t really want to settle, so they will try everything they can to scare people back into making payments on 100% of the balance plus interest first – locking them back into the same never-ending cycle of perpetually paying down inflexible loans.

Collectors use the threats that they think will be the most effective in getting borrowers to pay up.

I’ve spent quite a lot of my career negotiating a Navient loan settlement offer on behalf of my clients, and we are even seeing Navient loan try different tactics to twist and tweak their threats for maximum effectiveness. In the past, those who have contacted me for help settling (from private lenders) have told me that immediately before charge-off (6-8 months of nonpayment), they received a form letter that used very strong language – namely, that the account will be referred to a collection attorney and that they intend to file lawsuits. I have seen many times that this is just an empty threat, for the time being anyway.

After receiving these threatening letters about impending referral to an attorney collection agency to file suit, the accounts instead remained with the lenders’ internal collections department for several more months. During which time, I was able to negotiate lump sum and structured agreements.

Recently, this tactic has become even more exaggerated. Clients received the same letter, “signed” by the VP of Navient loan Credit, that specifically says their account will be referred to a law firm in the clients’ state upon charge-off – and it even names the collection firm, and says specifically that they intend to file a lawsuit. Instead, just as before, the client received calls the next month from a regular collection agent at Navient loan internal collections.

I don’t mean to be overly rough on Navient loan. Believe it or not, I’ve talked to some good people that work there in my many negotiations calls with them when trying to negotiate a Navient settlement offer, but at the same time I think it’s fair to criticize them for flat out lying to borrowers about what is happening during the private loan collection cycle.

What people don’t realize is that these scary sounding generic collection letters are mass produced and are completely identical – the only thing that is different is the name of the attorney collection firm in that particular borrower’s state. Navient loan made the calculation, which was very intelligent on their part, that naming a specific attorney collection firm in the borrowers state could get them to call in and make a payment before the account defaults.

It’s not time to panic, but it is time to take action.

If an account is actually referred to a collection law firm, it’s nothing to sneeze at, but the threat is often blown out of proportion. Private lenders can’t afford to lawsuits against every single person who defaults, ( read more about private student loan default here ), but they know that it’s an effective collection threat.

However, when this happens it’s necessary to make the account (Like Navient Loan Account) a priority if you haven’t already. It’s important not to panic or engage in doomsday thinking, but at also to understand that there is a potential threat of a lawsuit at this point. A reputable consumer defense firm can defend and settle unsecured debts during the legal process if a borrower is facing an actual lawsuit, but there are often many chances to settle on your own or with a non-legal negotiator prior to this happening. Even the debt collection law firms want to settle or get a payment rather than having to take someone to court.

Studies have shown that 80-90% of civil cases settle outside of court , and my experience reflects this also – I have negotiated with many law firms prior to litigation (there is usually always an opportunity to negotiate in between when the account is placed and when legal action commences).

Open all collection letters and take a proactive approach.

At the same time, many borrowers ignore mail – including court documents – and end up getting default judgments. Once a judgment is attained, the creditor can begin the process of trying to garnish wages or levy a bank account via judgment execution.

This is the worst case outcome and you want to do everything you can to avoid it. Taking a proactive approach to settling or negotiating a payment plan on unpaid debts is the best way to prevent this from happening. Open all your mail regarding collection accounts, and at the minimum screen your voicemails even if you’re not communicating with debt collectors who are calling.

If you’ve actually received a summons, you need to hire a reputable consumer defense attorney as soon as possible – there’s no two ways about it. However, this is the last step of a lengthy collection process, and if you’re proactive; you or your professional negotiator can work out a settlement or payment plan long before this happens.

Judgments can still be settled in some cases, but it’s usually better in the long run to settle accounts prior to a judgment being awarded to the creditor. Settling a judgment does not remove it from your credit report, but it will show that it has been paid. You will usually get a better settlement on a non-judgment account also.

I’ve never had a client get sued as long as they hire me to negotiate prior to the legal process being initiated by the lender.

However, I am quick to tell clients that I cannot provide legal advice, nor can I represent them in negotiations if they have been served a summons. In most states, you have 20-30 days to respond to a summons. I’ve heard that some borrowers have been able to negotiate a settlement even during that period, but in my (non-legal) opinion; the creditor has much more leverage during these types of negotiations and better settlement terms can be obtained prior to a lawsuit happening.

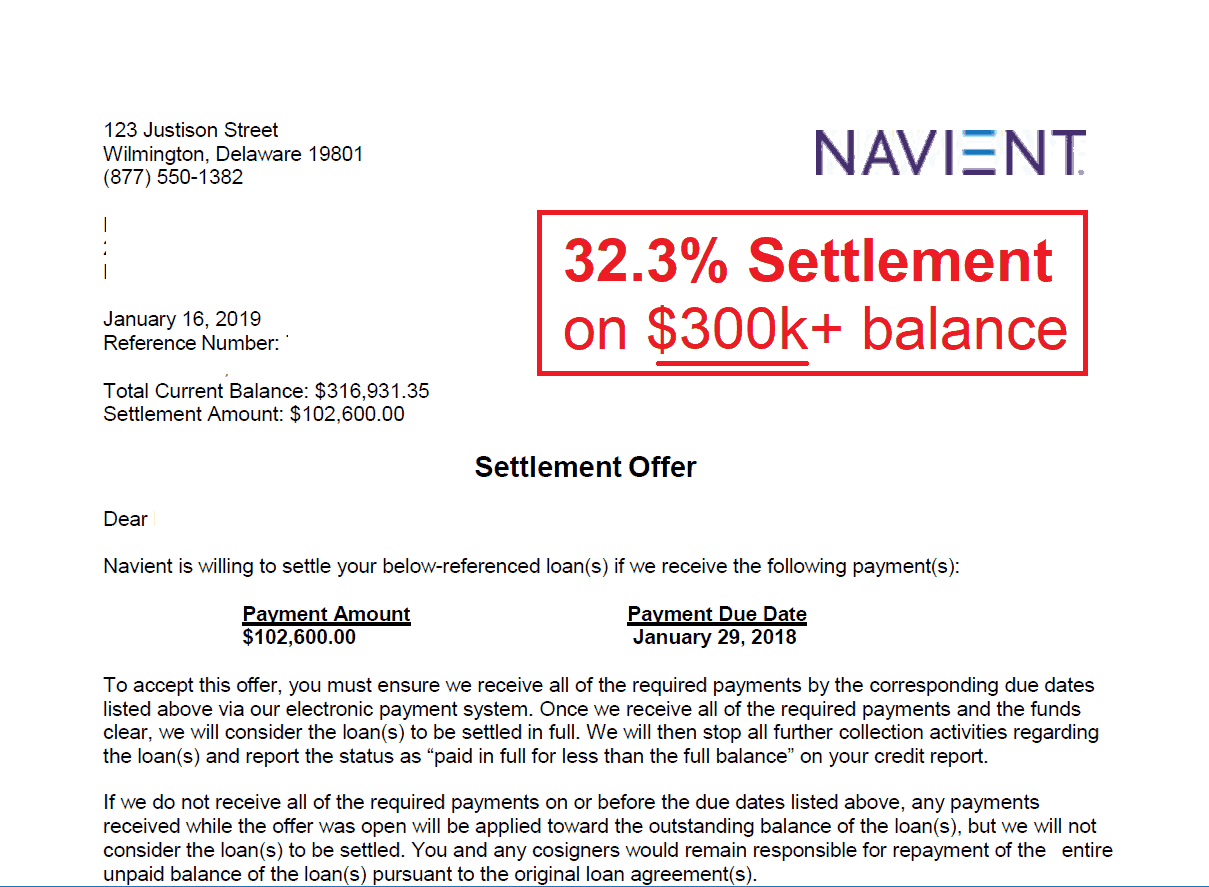

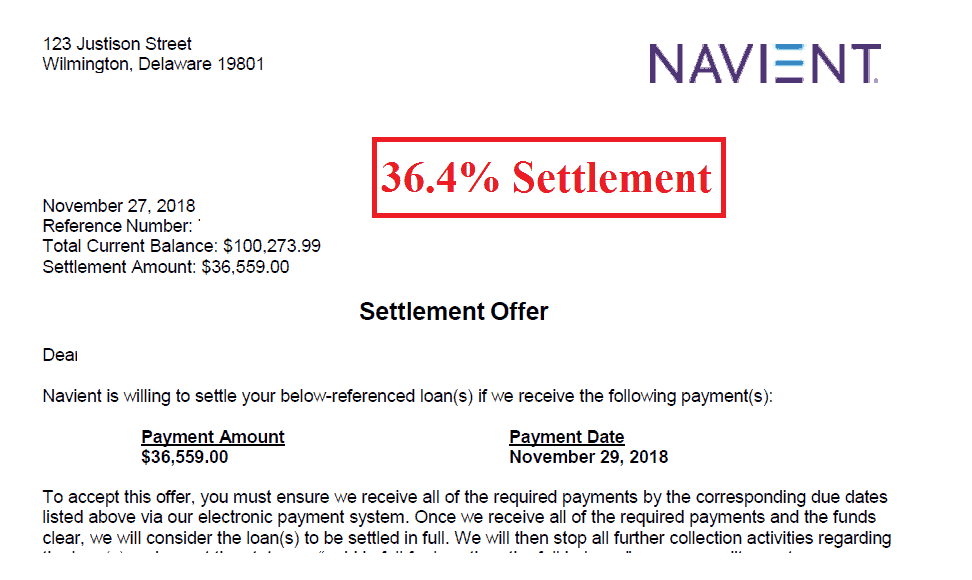

Settlements negotiated correctly can be less than half of the amount owed.

Taking a logical, strategic, and proactive approach to negotiating Navient loans or repayment planning affords the account holder many opportunities to reduce their balance before the long, winding path of debt collection leads to wage garnishment, liens, or bank account levy – the nightmare scenario that all defaulted borrowers fear, but far fewer actually experience.