How does settlement affect credit?

For those who are current on their loans and wishing to strategically default to settle – it is true that settlement is a trade-off of short-term (but significant) credit damage, in exchange for massive savings (both present and future), zeroing out your loan, and moving on with your life.

With successful credit disputing and credit building, you can rebuild your credit after a strategic default within two years or less.

For those who are already in default – guess what? The damage is already done and settlement will only help boost your credit once the zero balance is reported.

This is why my “new age” approach is to settle as soon as possible after default – maximizing savings while minimizing the time credit is damaged and limiting the risk of litigation.

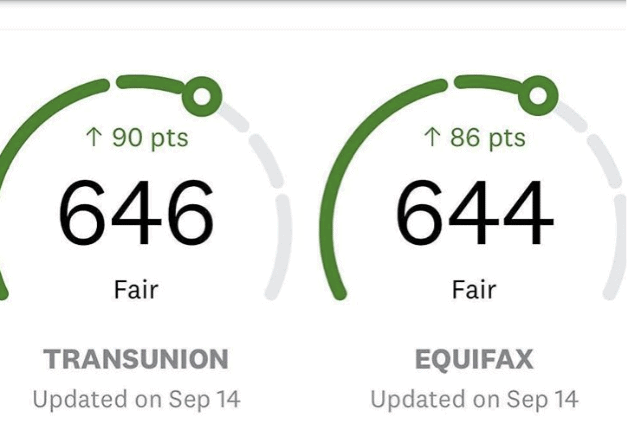

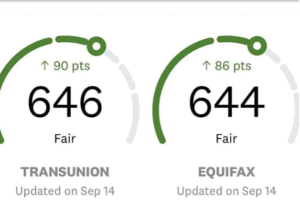

This is the result of a real client once their zero balance from the settlement was updated to their credit report.

The Truth About Settlement and Its Effect on Credit

The act of settling in and of itself actually does NOT hurt your credit (quite the opposite).

The act of settling in and of itself actually does NOT hurt your credit (quite the opposite).

It’s the late payments and default notation leading up to the negotiation that causes the damage – lenders will not agree to negotiate settlements until accounts are in default or close to it (depending on the lender).

Most of my clients and their cosigners are back into a good numeric credit score range within 6-12 months after they’ve paid off their settlement (if they have no other unresolved defaults).

Most of my clients and their cosigners are back into a good numeric credit score range within 6-12 months after they’ve paid off their settlement (if they have no other unresolved defaults).

Note – this means that “structured settlements” over 1-4 years take longer to recover from credit-wise than “lump sum” settlements.

Student loan borrowers and cosigners will have greatly improved Debt-to-Income and Debt-to-Credit ratios after they’ve settled – the account is reported as a $0 balance to the credit bureaus.

Student loan borrowers and cosigners will have greatly improved Debt-to-Income and Debt-to-Credit ratios after they’ve settled – the account is reported as a $0 balance to the credit bureaus.

This can make a huge difference in DTI, especially for those with six-figure balances. DTI is a common reason for being declined for a mortgage, refinance, and other lending products – even when the applicant has a great FICO score.

Credit often increases significantly once the settlement notation is updated with the credit bureaus (especially for recent defaults), and continues to improve over time post-settlement with a proper credit-building plan.

Credit often increases significantly once the settlement notation is updated with the credit bureaus (especially for recent defaults), and continues to improve over time post-settlement with a proper credit-building plan.

As a Certified Credit Counselor since 2011, I’ve reviewed hundreds of credit reports and helped many clients improve their credit records.

As a Certified Credit Counselor since 2011, I’ve reviewed hundreds of credit reports and helped many clients improve their credit records.

I include a copy of my comprehensive Credit Building Guide for each client post-settlement – as well as a referral to a legitimate, ethical, and effective credit repair company (from whom we receive zero compensation).

Building a new positive payment history after you’ve settled is crucial, and my Guide shows some innovative ways to do this. Successful credit repair can also jump-start this process.

The myth of permanently damaged credit and the inefficient, harmful model of “old school” debt settlement

There are so many misconceptions about debt settlement, but none more pervasive than the idea that it permanently destroys your credit.

The “old school” debt relief companies who charge HUGE amounts (like 25-30% of your ENTIRE BALANCE) are largely the reason for this idea – they let accounts sit in default for YEARS while saving up small monthly payments in the hopes of eventually settling before a lawsuit (a very ineffective model that often DOES result in lawsuits and years upon years of damaged credit).

The fact that they charge a huge amount of the total balance also takes away the ability to effectively allocate funds towards settlement in a timely manner. This is why you will get quoted a 4-5 year “term” when getting a sales pitch from a large debt settlement company – when in fact your loans could be settled within a matter of months – or even WEEKS (if you are already in default).

Credit Tools

The fundamentals of building credit and getting into a good score range are:

1

2

3

4

5

Credit Counseling

While I no longer offer credit counseling as a direct service, we’ve partnered with some great companies that can help you with a wide variety of credit issues.

Credit Recovery

Credit Recovery is the process of disputing inaccurate, outdated, or unverifiable listings in order to get them removed or altered on your credit file. Much like debt relief, it’s an industry that’s had it’s fair share of problems and bad actors.

Credit Monitoring

Credit monitoring can be super helpful during the credit building (or rebuilding) journey. While the free apps like Credit Karma can be a good baseline, they can sometimes interpret information inaccurately from the credit bureaus, and don’t update in real time.

The myth of permanently damaged credit and the inefficient, harmful model of “old school” debt settlement

There are so many misconceptions about debt settlement, but none more pervasive than the idea that it permanently destroys your credit.

The “old school” debt relief companies who charge HUGE amounts (like 25-30% of your ENTIRE BALANCE) are largely the reason for this idea – they let accounts sit in default for YEARS while saving up small monthly payments in the hopes of eventually settling before a lawsuit (a very ineffective model that often DOES result in lawsuits and years upon years of damaged credit).

The fact that they charge a huge amount of the total balance also takes away the ability to effectively allocate funds towards settlement in a timely manner. This is why you will get quoted a 4-5 year “term” when getting a sales pitch from a large debt settlement company – when in fact your loans could be settled within a matter of months – or even WEEKS (if you are already in default).

Instead of an actual negotiator or a certified financial counselor, those who call these generic debt relief companies end up talking with a salesperson, and that salesperson has every incentive to sign them on as fast as possible.

Unfortunately, this has historically led to deceptive sales pitches that omit the very important fact that accounts MUST be in default before any lender has the incentive to enter negotiations for any significant reduction.

It’s not the negotiated settlement agreement that hurts your credit – by the time it’s in default, the damage is already done, and the act of settling itself is actually the first step to rebuilding your credit. Just look at my real-life case study below, of a client’s credit improvement once the $0 balance from her lump sum settlement was reported to her credit.

Remember the credit score screenshot from the top of this page? It’s from an actual client who did a lump sum settlement. No other credit-building steps had been taken yet; this is only from the settlement itself being updated.

Results may vary and depend on each person’s credit profile. For example, if someone has multiple accounts in default, settling just one of them will not result in this kind of jump.

This account was the only defaulted account that my client had.

Generally, you will need to settle or pay off all defaulted debt to significantly improve your credit score.

Again – it’s the process of going into default, and missing monthly payments, along with the default notation itself; is what causes the credit damage.

Scores for both borrowers and cosigners can drop by 100-150 points or more from a current status, as they go late and build up months of missed payments. The default notation is the last credit hit – this is the point where the damage plateaus.

The good news is that this credit pain is only temporary, but it is unfortunately the “cost of admission” for the settlement ride.

No lender will settle when accounts are current and they are getting full payments plus interest, as that’s exactly what their business model is based on: you paying the original amount you borrowed several times over.

For the time to be ripe to negotiate a student loan payoff, the account has to become a defaulted “non-performing asset” for private lenders to gain the incentive to accept a reduced amount for a payoff.