Recent news reports have indicated that more than 1 million student loan borrowers are now at risk of defaulting on their loans. Many experts believe that this number will rise even higher before it is all said and done, with the current economic conditions contributing to borrower’s inability to repay their loans on their original terms.

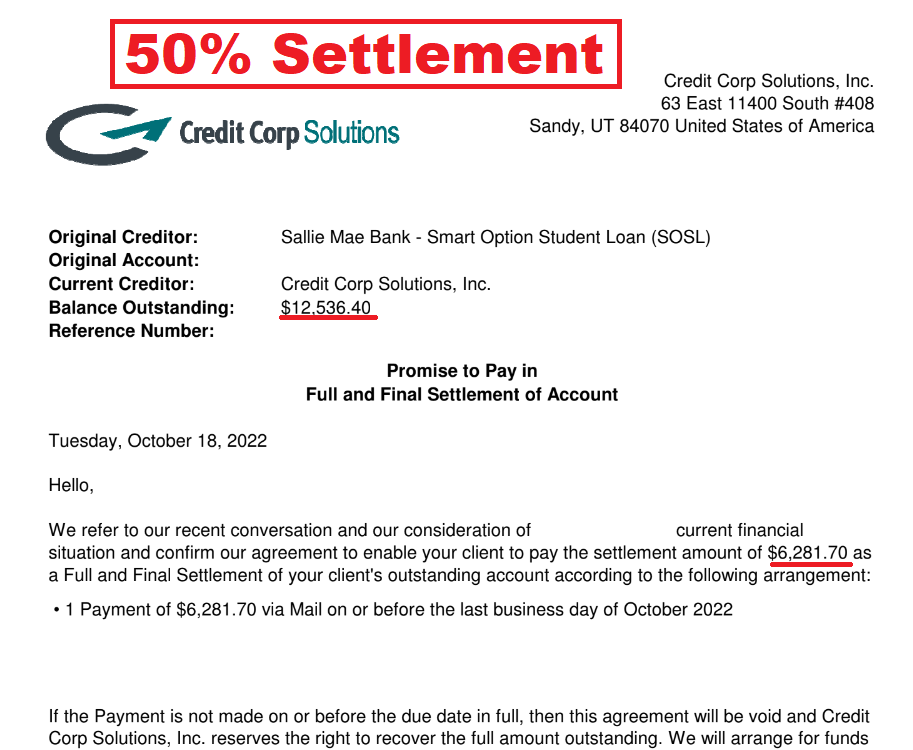

Fortunately, there are some options if you’re having a hard time with your private student loans – and there is a silver lining to default. Once a private loan defaults, many lenders are open to accepting a much lower amount to settle the loan.

There is a specific process and timeline to do this correctly, and I have heard many different theories from borrowers over the years.. but the fact is, it’s very difficult to do this on your own for the first time, unless a settlement just falls in your lap. And if so – it is likely not the lowest payoff that the lender will accept (usually, far from it).

When do private student loans default?

Unfortunately, there is quite a bit of misinformation on this topic. The CFPB says that private student loans “often default after 90 days”, but this is definitely not my experience. Rarely, some lenders will default at 90-120 days (3-4 months). However, most private lenders default after 6 months of missed payments (180 days) – lenders like Sallie Mae, National Collegiate Trust, Citizens Bank, etc.

One lender has managed to extend their charge-offs to a full 8 months of missed payments – Navient.

Potential effects of a private student loan default (also known as a private student loan charge-off)

The consequences of an individual or business going bankrupt can be devastating, but what happens when that same person defaults on their private student loans?

When you go through bankruptcy, your credit is ruined for the time being – and it takes quite a while to recover. This makes it very difficult to get new credit cards or personal loans. Private student loan default does not impact your credit as heavily as a bankruptcy or for the same length of time – as long as you resolve the default with either a full or partial payoff (always get this agreement in writing).

Since most lenders require proof of good credit before giving you credit, this can have major implications for career and life changes. For example, someone who wants to start a family might not be able to do so unless they find other ways to pay off their debt. For anyone considering a strategic default in order to settle private student loans or other debt, it makes sense to carefully evaluate whether any credit based lending decisions will be necessary prior to defaulting and settlement.

Once you settle, your score will start to rebuild. Most of my clients are back into good numeric score ranges within 6-12 months after the settlement is completed (when the last settlement payment is made on the account).

A “lump sum” settlement will help your credit recover sooner than a “term” or “structured” settlement which involves payments over time.

Collection actions taken by the lender

Most lenders will initiate collection action against you if a defaulted loan is not resolved. This includes having a third-party collector work with the lenders to try and collect money for the debt; or possibly selling the debt to a debt buyer.

It is very common for lenders to go after additional income or assets as payment of the loan if they win a lawsuit, so it’s always important to settle prior to legal action occurring. This can vary by lender, but can be within months, years, or not at all. Generally, larger balances are more of a target for litigation regardless of the lender.

My approach is to minimize time in default, minimize credit damage, and maximize savings – while avoiding legal action. Contact me here if you’re interested in a settlement evaluation.

Bankruptcy options

If you can’t repay your federal student loans, you may be able to have other alternatives than filing for bankruptcy. These include income-based repayment or pay reduction programs, as well as loan forgiveness through federal or state programs. Direct Consolidation and Rehabilitation are the two main options to get a federal loan out of default.

For private student loans, the options are more limited. Aside from a full payoff, partial payoff (settlement), or making payments and letting your credit stay in the negative; there is one other option – defaulted private student loan refinance. This is offered by only one company at this time (www.yrefy.com), and is a good option for people who do not have funds to settle. If you do have funds, this is not the best option, because you will still be paying back 100% of the loan (but at a lower interest rate).

While bankruptcy can be a very difficult threshold to get over for a student loan of any type (due to the Adversary Proceeding process), private student loans sometimes qualify. However, this is not a route that is available to the majority of borrowers due to the 2005 BAPCPA excluding student loan debt from bankruptcy except for limited circumstances.

Private student loan default statutes of limitation

Statutes of limitation or “SOL” begin running after the DLA, or “date of last activity”, on your credit report. This is usually the last payment made prior to an account defaulting. Making a payment will restart “SOL”. There are many other things that can restart statutes of limitation such as acknowledging that you owe the debt – each state has different statutes. Usually the “SOL” period will be anywhere from 3-7 years, with some states even being up to 10 years for written contracts. States may use either credit card statutes of limitation or written contract statutes of limitation for private student loans.

I’ve heard from quite a few people who were trying to wait out SOL and instead ended up with a lawsuit – which usually means they also lost the chance to settle for as low as possible in the collection cycle. The best deals usually come prior to placement with a law firm and litigation. Waiting out SOL is a coin toss, and a high risk strategy. Generally, smaller accounts have a better chance of staying off the radar, while larger accounts will be the target of focused collection activity and legal action. This is just a general rule though, and some lenders (looking at you NCT) will sue on even very small balances – like clockwork.

Some tips for borrowers

Recent developments in student loan debt have resulted in this topic being in the news quite often. Amid all the noise around federal loan forgiveness, many people are wondering what their options are for private loan forgiveness. Realistically, private student loan settlement is the closest thing to forgiveness that exists – these types of loans will not qualify for any federal loan forgiveness

The next step in dealing with defaulted student loans is to make sure you have a plan – whether it is Direct Consolidation or Rehabilitation (for federal loans), or a partial or full payoff for private loans – or potentially default refinance if you can’t afford to settle for a much lower balance.

Private loans do not have rehabilitation or income driven programs. You can make payments on a defaulted private loan, which may or may not prevent the lender from moving forward with legal action. The huge problem with this approach is that the account will still appear to be unresolved on credit reports, preventing you from buying a home, refinancing, etc. Even though you are paying on the loan, it will not show as “paid as agreed” and will still be a negative listing.

There are options, but no “silver bullets”. Settling a private student loan in default requires coming up with some funds, knowing when to start negotiating, and with whom. Even if a loan is being settled for 1/3 or 1/4 of what is owed, this can still be a substantial sum of money. It’s best to protect this “investment” by hiring a professional who already has pre-established negotiating relationships, has a great deal of experience, and a decade or more of negotiating strategy under their belt.