If you have private student loans, facing default can be a scary and uncertain proposition – but it doesn’t have to be. Although there are less options than with a federal student loan to get back into good standing, you may have an opportunity to slash your balance by 50% or more with a settlement payoff.

There are no widespread private student loan forgiveness programs, and the federal government does not have the authority to enact any for private lenders (whether they have that authority for federal loans is highly debated as of this writing).

A very small amount of private student loan borrowers who attended for-profit schools during a certain time period and took out loans with Sallie Mae (now transferred to Navient) will receive student loan forgiveness.

However, the amount of accounts in question is less than 2% of Navient’s total private loan portfolio. (For more info on this, click here to check out my video explaining the Navient lawsuit.)

For everyone else, a private loan default can be cured by either a full payoff, a student loan settlement for less than the balance, or in some cases a refinance (more on this later).

Keep in mind that you may have to choose the least-worst option for your situation, as there are no perfect or painless solutions.

Private Student Loan In Default

If your private student loan goes into default, here are some next steps you can take:

Hire A Professional To Contact Your Lender And Review Your Loan Agreement:

As your financial situation changes, it’s important to be proactive in exploring alternative payment arrangements with your provider. In the event of default, the first step is to have a professional and experienced expert reach out to your lender and initiate a discussion about potential solutions.

Remember that your lender’s primary objective is to receive payment, and they may be willing to work with you to avoid the need for collections or legal action.

One possible avenue is negotiating a new repayment plan that better fits your budget – however, this is not the best option as the accounts will remain in a negative standing on credit reports until fully paid off. Once loans are in collections, you are no longer eligible for a forbearance period. It’s also worth inquiring about rehabilitation options if your loan is federal, which involve making a series of good-faith payments to demonstrate your commitment to fulfilling your obligations. Unfortunately, this is unavailable for private student loans.

If The Lender Doesn’t Have A Court Order

It’s important to note that if you have a private student loan, the lender will typically try to collect the debt out of court before resorting to legal action.

However, if they do take legal action, they must obtain a money judgment against you before using collection tools such as garnishment.

It’s worth mentioning that federal student loan lenders do not need a money judgment to use collection tools. In the case of a private lender, they may also hire a third-party debt collector to assist with collection efforts.

As a borrower, it’s important to be aware of these potential collection methods and take action to address any defaulted loans as soon as possible, to prevent potential legal action.

Refinance With a Different Lender

As someone who has considered refinancing their student loans, it’s important to note that private student loans were widely popular before the 2008 financial crisis.

However, due to increased default rates during the Great Recession, most major bank financial institutions stopped lending to students. Since 2014, private student loan lenders have resumed offering loans and a range of refinancing options.

It’s essential to shop around and compare the terms and rates of various lenders to ensure you secure the best option for your unique circumstances. In case you have a good credit score and income, you may qualify for a lower interest rate or an extended term.

On the other hand, if you’re in default, a traditional refinance (even with a creditworthy cosigner) will be out of reach. There is an option for default refinance, which can be a good choice for those who don’t have funds to settle.

It’s important to note that while you can refinance a federal student loan with a private loan, the reverse is not possible. Before refinancing your federal loan, ensure that it’s in your best interest to do so.

Request Verification And Dispute The Unverified Debt

As a first step when contacted by a collection agency, it is important to verify the legitimacy of the debt in question – if there is a doubt that it’s legally yours. Legally, the agency is required to provide documentation that proves the validity of the debt. You only want to take this step if you truly think that the loan could not be yours – otherwise, lenders can respond aggressively due to overuse of this tactic.

A Whole Different Ballgame Compared To Federal Student Loan Lenders

Unlike federal student loans borrowers, there are no monthly payment options to bring privately held defaulted loans current (loan rehabilitation does not exist for private lenders).

Making monthly payments on a defaulted loan will not report as paid as agreed, nor bring the loan back to a current status.

There are no income-driven repayment plans either. The one exception to this is one of the debt buyers who purchases Sallie Mae defaults – they do allow people to make payments and they report the loan as a new current tradeline. However, Private student loan debt went up by $16.8 billion, or 14%, in 2020.

Also unlike federal loans, default usually happens after late payment for 4-8 months, depending on the private lenders policies. At the time of default, your loan can take several different routes depending on your private student loan lender’s practices.

This can be nerve-wracking to try to figure out if it’s your first time going through it, which is one of many reasons to consider hiring a professional negotiator.

Negotiator

If you’re negotiating on your own, you won’t really know if you are getting the best possible deal or if the settlement is executed correctly.

Maybe the debt collector has the authority to approve a 40% agreement with monthly student loan payments on the settlement, but they are bluffing and say that it can’t get approved, that this is the lowest they can go, etc.

This is why it can help to hire a professional negotiator, who not only will have knowledge of what is and isn’t possible from experience with many private student loan settlements with your lender; but will likely also have existing relationships with these lenders and debt collectors.

The account can be assigned to a collections agency, sold to a debt buyer (although this is not as common as it is with credit card debt), or retained by the lender and sent to an in-house collection department.

Private student loans in collections can then be subject to legal action from collection attorneys, at any point up to when the statute of limitations runs out.

For most states, “SOL” is between 3-6 years; sometimes more. Larger balances tend to receive more scrutiny from legal collection agency debt collectors, but I’ve heard of lawsuits on balances as low as $2,500 – it’s just highly dependent on the lender’s policies.

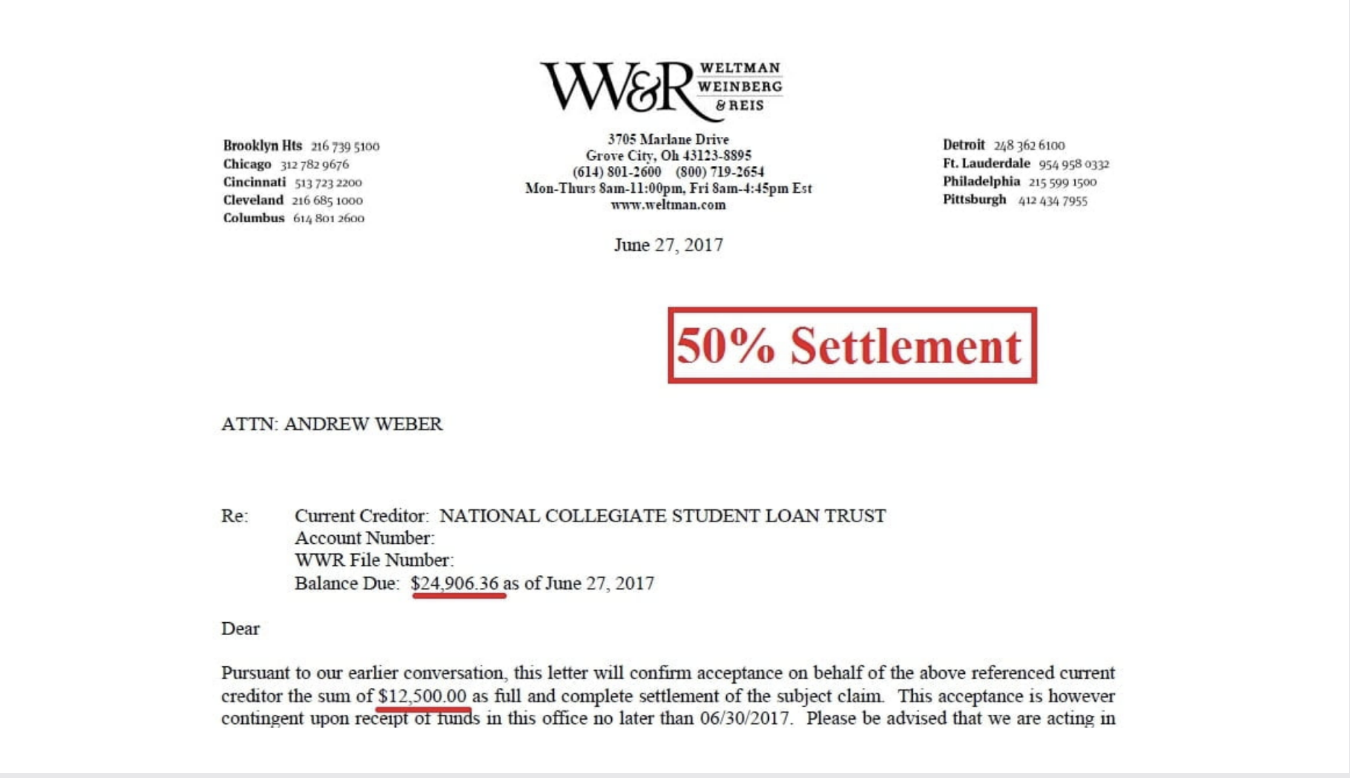

Go With Settlement

Settlement is the most aggressive, and most impactful way to get out of collections.

While it will not report the loan as current, it does zero out the balance and report as settled for less than the full balance to credit reports – something that looks much better than an unresolved default, and which paves the way for credit rebuilding.

Getting back into a good score range is a matter of building new, positive payment history while waiting for the negatives to age into the past, and this process of rebuilding credit scores can take 1-2 years post-settlement.

A secured credit card can also help improve poor credit. In many cases, the negotiated payoff itself will cause a significant increase in score reported by the major credit bureaus (this is more common for recently defaulted accounts vs those that have been charged off for several years or more).

The credit reporting difference between paid in full, settlement, and deletion isn’t as wide of a disparity as is commonly assumed.

A Credit Karma analysis of over 2 million members showed that settlement results in only a 4 point lower increase than a full payoff, and only a 2 point lower increase than a deletion.

Better Settlements Option

Negotiated payoffs can be either with a “lump sum” or a structured settlement, depending on the lender’s policies.

Lump sum settlements are paid in one shot – typically by the end of the month that the negotiation is finalized – and are usually a lower percentage than what will be available for a settlement paid in installments (if negotiated correctly).

The unpaid balance remaining is then cancelled by the lender.

Many private student loan lenders will allow structured settlement arrangements to go out two or more years – and this is on a fixed negotiated balance with no interest or late fee accrual.

Structured Settlement

A structured settlement is a negotiated, fixed payoff balance that is usually paid over 2 years or less.

Most lenders will want a down payment on the settlement (I recommend aiming for at least 1/3 of the settlement amount as the down payment), with the remaining balance divided up over the agreed upon term. However, there are some risks when it comes to these types of arrangements.

Unlike a normal payment plan, the structured payment plan must be paid every month and missing even one payment can result in the entire settlement being voided, with the amount already paid being applied to the full balance – and the loan re-entering active collections including potential legal action.

So, I always recommend to all of my clients who choose this route to make sure they are 100% sure they can make every payment on time; and have some kind of a backup/emergency savings if they encounter an unexpected income or employment issue.

For this reason, I also recommend not to go over a two year term even if the lender will allow it. That’s just too long of a period of time, and too much uncertainty, to enter into an agreement that will fall apart if one payment is missed.

Borrowers that have larger balances will find it difficult mathematically to do this type of process, unless they have a lot of reliable discretionary income.

Most of my larger balance clients need to utilize some kind of asset, savings, 401k, HELOC, loan from a bank or family member, etc. for a lump sum settlement on a large or six figure balance settlement.

I’ve done many settlements in the $100-$200k range, a handful in the $200-$300k range, and my largest was a balance of $317k. In all instances except one, they were lump sum settlements.

Structured Settlement Example

Let’s take a closer look at why this is. For our example, let’s start with a $30k private student loan in default. Either you or a professional negotiator gets an agreement in place at 55% of the balance.

That would be a settlement of $16,500.

With my recommended 1/3 of the settlement amount as the down payment, that would come to about $5,500 down.

Over a two year term, the remaining balance would be split up into monthly payments of about $480 per month.

The down payment counts as the first payment, so there will be 23 installments following that.

While these numbers are nothing to sneeze at and will take some discretionary income and savings or borrowing for the down payment; this type of arrangement is doable for many people I talk to.

For Larger Balance

But now let’s look at what a structured loan agreement would look like on a larger balance – let’s say $90k. The math now becomes much more difficult, even with a large down payment.

For our example, let’s assume a 55% settlement is negotiated again – that will come to $49,500.

1/3 of that amount down would be $16,500; leaving about $33,000 to be paid over a 2 year term.

Over 23 months, that would come to $1,434 per month – something out of range for most people as that is a mortgage sized payment.

The only options to get a structured settlement lower at that point are to either negotiate a lower payoff, increase the down payment, or lengthen the term.

Downside

The last option is not recommended for reasons I mentioned earlier, and many lenders won’t agree to anything past 2 years regardless.

Another downside of structured term arrangements is that the credit reporting agencies will not be updated with a $0 balance and settlement notation until after the last payment has been made. This extends the credit rebuilding timeline following settlement – whereas with a lump sum, the credit report is updated within 1-2 months max after the payment has been made.

Other Options When In Default

Private student loan borrowers do have some other avenues besides settlement. Paying off the loan company in full is usually not an option for the vast majority of people (and would miss out on thousands of dollars in potential savings vs. a negotiated payoff).

Doing nothing and trying to wait out the default period is fairly risky and can result in an unexpected student loan lawsuit – not to mention endless collection letters, calls, and collection threats.

However, some people have been able to age their loans past credit reporting timelines and the amount of time lenders are allowed to pursue legal action, without dealing with majorly aggressive collection activity.

Collection efforts are different for each loan company, but you can expect for them to not let that loan ride off peacefully into the sunset without a fight.

Lenders have significant collection powers including the ability to garnish wages, levy a bank account, or go for a property lien – but these are only possible after they have won a judgment in a lawsuit.

Other collection methods are limited to calls and letters, and unlike federal student loan lenders, they can never take your tax refunds.

Be Careful About Validation Services

Over the last few years there have been quite a few companies pop up that claim that, without licensed attorney’s in the borrowers state, that they can get your loans “invalidated” or dismissed somehow by doing legal-yet-not-legal challenges.

There is such a thing as validation under the Fair Debt Collection Practices Act, but in practice, it is very unusual for an account to be dismissed with this procedure.

Validation is simply not a reliable way to solve this kind of problem, although it does serve a purpose. I’ve written more about what validation can actually do, the proper way to use it, and red flags to watch out for with companies that claim they can make your loan disappear.

Click here to read my article about validation services

The old adage is correct in this case – if it sounds too good to be true, it probably is. To date, I’ve helped clients who have enrolled in these types of services before contacting me to get refunds totaling $20,000.

In each case, nothing was happening and their lender simply ignored the letters and absurd requests the validation company sent them.

FDCPA Validation only applies to third party debt collectors and is fairly limited in scope – as well as having a low threshold for the debt collector to meet in response to any validation or verification requests.

Can You Refinance When In Default?

The answer used to be no – but there is at least one company offering this service now. Yrefy (pronounced Why-Refi) is a company that specializes in refinance of private loans in collections, and I spent some time over the last year getting to know their team.

It’s definitely an innovation within the market for student loans, and a much-needed additional option for borrowers.

If you qualify, Yrefy will actually pay off your defaulted private loan, and then reissue the balance to you at a low interest rate and a tradeline that reports as current.

While the credit damage from the previous late payments will still be there, the new positively reporting tradeline often results in significant improvement to the credit profile. The monthly student loan payment on the refinanced loan is usually about 1% of the balance with an average 3.9% fixed APR, which is an affordable repayment plan for many. Unlike a negotiated payoff, there is no down payment required.

Yrefy helps borrowers with bad credit, and can be a good option for those who are unable to afford settlement. Most other refinance lenders, such as SoFi, Earnest, Laurel Road, etc. will only accept applicants who are current.

No funds for a settlement? Click here to apply for default refinance with Yrefy

Choosing The Best Option For Your Private Student Loan Default

Finding the best solution for your unique situation is definitely not “one size fits all”. There is unfortunately no fast and easy way out of default; for example, there’s no private equivalent to federal loan consolidation (one of the fastest and painless ways to get out of accounts guaranteed by the federal government).

If you’re interested in private student loan settlement, that is the primary service I offer. I’ve settled millions and helped hundreds of borrowers – and I can help you too.

I’m performance based, so you only pay me a small percentage of the total savings (10-20% based on loan amount), and only if a settlement is reached. My process and strategy is customized to each individual client’s situation, and this is part of the reason why I have over 20 five star reviews on Google.

Have you had enough of that private loan in collections weighing your life down and holding back your future? Then click here to request a free evaluation today.