The Science Of Navient Private Loans Negotiation

Click here for a free private student loan review

Are you struggling with Navient private student loans?

- Are your loans in default, and hurting your credit?

- Are you current, or a few months behind, and dealing with rising interest rates and high payments?

- Maybe you’re a cosigner, who feels stuck with these loans?

Whatever your situation, I can help you find the right path to a $0 balance!

Check out my advice, settlement examples, and reviews on social media:

Instagram

Tiktok

Google

Facebook

Linkedin

Youtube

READY TO START YOUR JOURNEY

TOWARDS BEING DEBT FREE?

Start by filling out the form below

Private Loan Settlement Appears To Be Tax Exempt For A Limited Time!

Worried about being taxed on the savings with a 1099-C? Many lenders don’t seem to be issuing them right now – IRS guidelines resulting from the American Rescue Plan dictate that private loan cancellation is tax exempt from 2021 until 2025.

Take advantage of private student loan settlement tax exemption before it expires! Navient Private student Loans are qualified from this exemption.

Private student loans will never be forgiven such as Navient Private student loans by the federal government, and the Navient Attorney General Lawsuit cancellation has already been processed for those rare few (2% of Navient private loans borrowers) who qualified.

However, you still have a historic opportunity to get a large part of your balance loan wiped out, without having to worry about a tax bill.

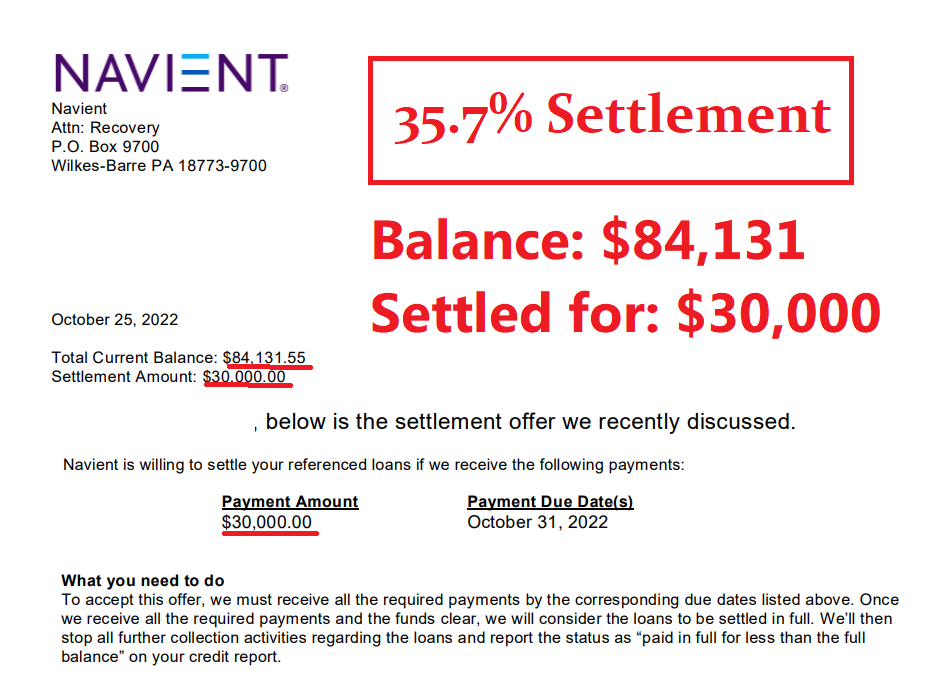

More Settlement Examples:

Slide HeadingLorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Click HereSlide HeadingLorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Click HereSlide HeadingLorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Click HereSlide HeadingLorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Click Here

Previous

Next

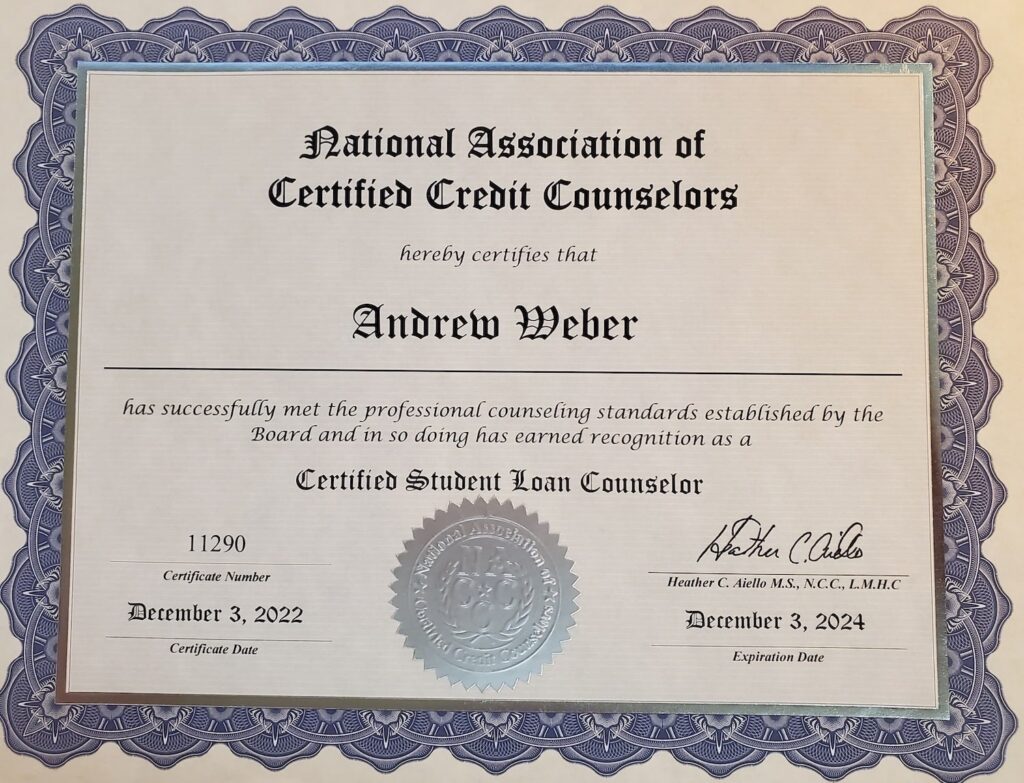

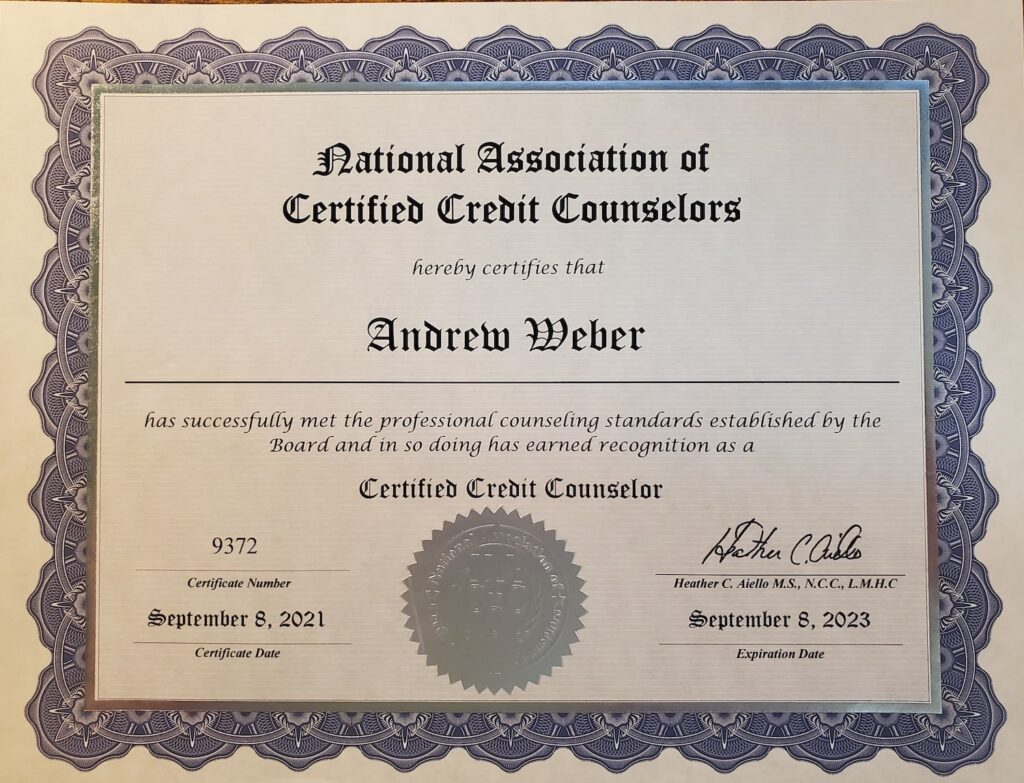

About Andrew Weber C.C.C., C.S.L.C.

I’m a NACCC Certified Credit Counselor and a NACCC Certified Student Loan Counselor specializing in settling high balance, high risk private student loans (among other types of private student loans, like navient private student loans and unsecured debt).

I settled my first credit card debt in 2009, and my first private student loan in 2013 (with Sallie Mae). However, I have some Navient Private Student Loan settlements.

I take on accounts as small as $3,000, and as large as $300,000+. Small balances can actually cause big problems for people.

But big balances can cause really big problems, and are much more likely to be targeted for litigation after default (sometimes within a matter of months).

My philosophy is to minimize this legal risk, and minimize the amount of time that credit scores are damaged; while maximizing savings.

Private student loans have to be in default in order to be settled for a significant reduction.

Credit scores bounce back within a year or less after settlement is completed in most cases, and Debt to Income (DTI) improves immediately after settlement.

Settlement itself is the first positive movement for credit scores – the damage comes from the preceding late hits and default notation.

These can sometimes be removed with expert credit repair, but the damage from them fades over time even without that.

I also provide a 17 page comprehensive Credit Building Guide for all clients post settlement.

Click here for a free private student loan review

Click the links below to read my quoted student loan advice:

Why Choose Andrew Weber?

![]()

Destroy your

balance

I have over 14 years of experience and have successfully achieved 30-50% on average for settlements, and sometimes lower; settling millions in private loans, credit cards, and more. We will get rid of your private student loan for once and for all.

![]()

drastically improve your finances

By negotiating reduced settlements on your private loans, I will clear the way for you to rebuild your credit, help you improve your debt to income ratios, and help you qualify for the life that you deserve.

![]()

Feel what it’s like to be DEBT FREE

Experience the relief of being debt free from burdensome private loans that never seem to go away or go down. Settling private loans is truly a life-changing experience.

![]()

Settle private student loans before lawsuits occur

We have helped hundreds of borrowers and co-borrowers prevent lawsuits, liens, bank levies, and other forced collection actions on private loans by settling accounts before lawsuits occur. We have never had a client get sued.

14 Years Of Full Spectrum Debt Negotiation Experience:

I’m the top non-attorney private student loan settlement specialist in the United States, having helped hundreds of borrowers settle all types of debts (but especially private student loans like Navient Private Student Loans) for much less than the balance owed.

I have settled multiple millions of private student loan debt with all of the major lenders, and many minor ones as well.

Want one of these? I can help you get there.

I’ve negotiated on accounts from lenders such as:

- Chase,

- Navient,

- Sallie Mae,

- NCT,

- Turnstile Capital Management,

- Barclay Bank,

- Discover,

- Keybank,

- Wells Fargo,

- Citizens Bank,

- Citibank,

And many more.. not to mention dozens and dozens of different collection agencies, law firms, servicers, and debt buyers in addition to original lenders, banks and credit unions.

With this experience, and the negotiation relationships I have built with various lenders, collectors, law firms, etc; I’m able to get spectacular results for my clients – consistently.

Aside from refinance, settlement is the only real form of significant cancellation relief that is available to the vast majority of borrowers, aside from refinance. (Don’t fall for private student loan debt validation scams)

While high balance, high risk private student loan settlement is my specialty; over the last 14 years I’ve also settled:

- credit cards,

- student loan refinances,

- bank loans,

- credit union loans,

- federal student loans (in rare cases only),

- medical debts,

- signature loans,

- FinTech/online lending platform loans,

- auto loans (after repossession),

And even a client’s legal bill, owed to a criminal defense attorney (definitely one of my most interesting negotiations).

A lot of people think that credit counselors and financial professionals never make their own mistakes or end up in bad situations themselves – this couldn’t be farther from the truth.

Between starting my business in the shadow of the Great Recession, or navigating the first couple years of the pandemic as a small business owner – I’ve dealt with my fair share of hardship and financial struggle.

At different points over the past 15 years, I have:

- Been in heavy credit card debt

- Represented myself in court against a credit card lawsuit and settled it with the opposing counsel

- Been in default on federal and private student loans

- Consolidated my own federal student loans out of default and applied for income driven payments

- Settled my own private student loans

- Owed over $100,000 in debt

- Gotten hit with thousands of dollars of medical bills that I thought my insurance would cover after surgery

- Settled many of those medical bills

- Experienced my credit score dropping into the 400s

- Experienced my credit score rising into the 700s

I know what it’s like to face the same battles you’re facing.

Personal finance is a journey at any time, but especially during the tumultuous and unpredictable global events of the 21st century.

My personal experience and struggles have helped to inform my business practices and allow me to connect on an emotional level with others who are going through some of the same things I have.

Think of me as the Yoda to your Luke Skywalker.. I will guide you through this process, and help you become your own hero.

Things CAN get better with consistent effort and the right strategies! Just ask any of the people in the Google Reviews pop-up on the bottom left.

What My Clients Say

Rob Pralow☆☆☆☆☆ Read More

“I will say that working with Andrew has been amazing I will be honest I was very skeptical about him negotiating with Navient because they did not work with me so I was constantly being bombarded with calls from them so I talk to Andrew and within 24 hours he was able to get those calls stop and he was able to negotiate my Navient student loans from 112k down to under 36k within two months. Andrew explain to me the process he was very patient and understanding and really showed that he cared about my situation it is because of him I am not ashamed to look at my college degree and feel like I made a bad choice in going to college after I paid off Navient I look at my college degree with pride and I recommend anyone if you have private student loans please talk to Andrew he is a life saver. If t could give you 10 stars I would thanks again”.